What to Watch For Before Earnings: Ford, Tesla, GM, Toyota, Zipcar

It's that time of the year again. Every Fool's favorite quarterly celebration -- earnings season -- has arrived. With that in mind, this series will give you a heads up on reporting dates, analyst expectations, and past earnings performance for a variety of Industrials stocks. First up is the auto industry.

Why is this important? Well, even though we don't believe that moving in and out of the market in the short term is the best strategy, we still like to arm ourselves with regular information. Each earnings report gives you the opportunity to learn much more about a company's recent performance. Whether you're checking in on a stock you already own or looking for the next company to add to your portfolio, we'll show you here what to expect during the course of earnings season.

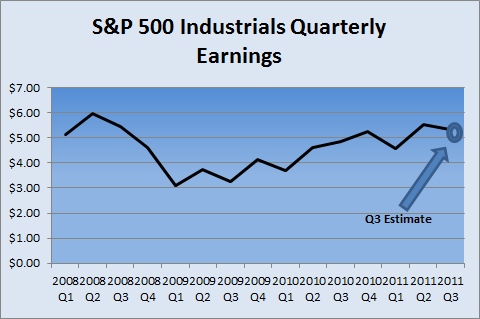

Source: Standard & Poor's.

As far as industrials as a whole, there's some good news and some reason for pause. Let's go with the good news first. Year-over-year, earnings are expected to increase 10% compared to 2010's third quarter. However, the expected earnings trend for the industry this quarter is slightly worrisome. THE 2011 second-quarter earnings rise is not expected to continue in the third quarter, as analysts believe overall earnings will decrease by 3.6%.

Part of this decrease could simply be seasonality. Since 2009, Industrials companies have tended to show decreases in earnings in Q1 and Q3, while they tend to grow their earnings in Q2 and Q4. This could help explain some of the drop that we're expected to see in the sector this quarter.

Now that you've got the big picture for Industrials, let's zero in on the auto industry and show you what to expect over the next few weeks.

Company | Estimated Report Date | Estimated Earnings | Earnings Estimate 90 Days Ago | Year-Ago Earnings | Earnings Reported Last Quarter |

|---|---|---|---|---|---|

Ford (NYS: F) | Oct. 25 | $0.44 | $0.38 | $0.48 | $0.65 |

Honda (NYS: HMC) | Oct. 28 | $0.27 | $0.46 | N/A | $0.22 |

Tesla (NAS: TSLA) | Nov. 2 to Nov. 7 | $-.59 | $-.53 | $-.37 | $-.53 |

Zipcar (NAS: ZIP) | Nov. 2 to Nov. 12 | $-.01 | $-.02 | N/A | $-.17 |

General Motors (NYS: GM) | Nov. 7 to Nov. 10 | $0.90 | $0.96 | N/A | $1.54 |

Toyota (NYS: TM) | Nov. 9 | $0.39 | $0.48 | $1.32 | $0.00 |

Sources: Yahoo! Finance and Earnings.com. Earnings report dates subject to change.

Honda and Toyota are both expected to see healthy earnings increases from last quarter as the companies were finally able to ramp up production following the Japanese tsunami. The fourth quarter will be the big measuring stick for Toyota -- the company expects to make up a considerable amount of the U.S. market share it lost by the end of the year. Tesla and Zipcar continue their struggle to become profitable. It will be interesting to see updates on Tesla's new Model S, especially the updated reservation count for the new sedan due in mid-2012.

Ford and GM aren't expected to post as strong earnings as last quarter, but third-quarter earnings are traditionally lower for the two big automakers. August and September sales were still strong, and it looks like both Ford and GM remain on the right track. As long as Ford can follow GM's lead and come to an agreement with the UAW, the future looks bright for both companies.

Of course, in an industry as highly cyclical as the auto industry, car sales and auto companies earnings often follow consumer economic sentiment and macro factors. Here's to hoping that strong September auto sales mean good things for the economy as a whole in the future.

We Fools believe that the accumulation of knowledge is crucial to making wise investment decisions. To explore some other investing ideas, check out The Motley Fool's report on the "13 High-Yielding Stocks to Buy Today." The report is completely free, and includes a high-yielding Industrials company hand-picked by our analysts. Get access to these 13 high-yielders -- it's free.

At the time thisarticle was published Fool contributor Brendan Byrnes owns shares of Ford. The Motley Fool owns shares of Ford and Zipcar. Motley Fool newsletter services have recommended buying shares of Zipcar, Ford, and General Motors. Try any of our Foolish newsletter services free for 30 days. We Fools don't all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2011 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.