A Brief History of McDonald's Returns

Despite constant attempts by analysts and the media to complicate the basics of investing, there are really only three ways a stock can create value for its shareholders:

Dividends.

Earnings growth.

Changes in valuation multiples.

In this series, we drill down on one company's returns to see how each of those three has played a role over the past decade. Step on up, McDonald's (NYS: MCD) .

McDonald's shares have returned 300% over the past decade. How'd they get there?

Dividends accounted for almost one-third of the gains. Without dividends, McDonald's shares returned 214% over the past 10 years.

Earnings growth during the period was stellar. Since 2001, McDonald's earnings per shares have grown at an average of 14% per year. That's well above the market average, and incredibly strong for a mature company like McDonald's. Two big forces have driven earnings-per-share growth: international sales, and a reduction in the number of shares outstanding.

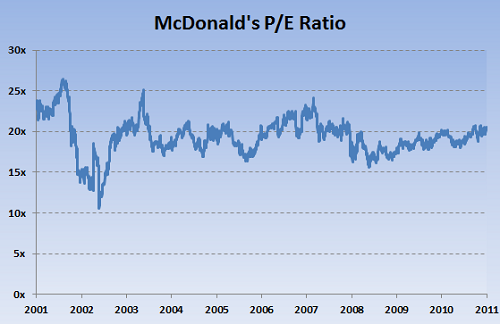

Now, most companies have seen their earnings multiple decline over the past decade. Interestingly, that isn't the case for McDonald's:

Source: S&P Capital IQ.

This is important. Some investors look at the lofty performance of McDonald's stock and worry that it's a sign shares are overvalued. But when you consider that most of the returns have been driven by earnings growth -- not an increase in the valuation multiple -- that's a hard argument to make. It's the other way around for companies like Chipotle Mexican Grill (NYS: CMG) and Green Mountain Coffee Roasters (NAS: GMCR) , where returns in recent years have been driven in large part by multiple expansion. There's nothing inherently wrong with multiple expansion -- it's well deserved a lot of time -- but the returns McDonald's has produced for shareholders over the past decade have been more tangible than what you can find in other companies. And that's a good thing.

Why is this stuff worth paying attention to? It's important to know not only how much a stock has returned, but where those returns came from. Sometimes earnings grow, but the market isn't willing to pay as much for those earnings. Sometimes earnings fall, but the market bids shares higher anyway. Sometimes both earnings and earnings multiples stay flat, but a company generates returns through dividends. Sometimes everything works together, and returns surge. Sometimes nothing works and they crash. All tell a different story about the state of a company. Not knowing why something happened can be just as dangerous as not knowing that something happened at all.

Add McDonald's to My Watchlist.

At the time thisarticle was published Fool contributorMorgan Houseldoesn't own shares in any of the companies mentioned in this article. Follow him on Twitter @TMFHousel.The Motley Fool owns shares of Chipotle Mexican Grill. Motley Fool newsletter services have recommended buying shares of Green Mountain Coffee Roasters, Chipotle Mexican Grill, and McDonald's. Motley Fool newsletter services have recommended creating a lurking gator position in Green Mountain Coffee Roasters. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2011 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.