Earnings Season Preview: What to Expect From the Biggest Names in Tech

Ah, earnings season -- those four times each year when investors get to kick the tires of their holdings and check out any prospective investments. The market both richly rewards those that pass the test and shuns those that fail to make the grade.

Suffice to say, it's a crazy time of year. And although we here at the Fool don't believe in investing quarter to quarter, each earnings season does provide some much-needed information for investors. In that vein, here's what you can expect from your some of the highest-profile names in the tech sphere as they report over the coming weeks.

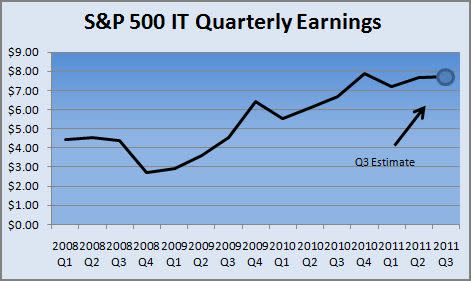

Source: Standard & Poor's.

Analysts expect generally improving performance from IT firms. They see year-over-year earnings growing by 15.4%, a pretty impressive performance if it comes to fruition. The Street also expects improvement over Q2 for the industry, but just at a 0.5% rate, given the current conditions in the U.S. and abroad. Here's an earnings calendar for 20 of the biggest names in the sector.

Company Name | Expected Reporting Date | Expected EPS | Year-Ago EPS | Reported EPS Last Quarter | % Surprise Last Quarter |

|---|---|---|---|---|---|

Google (NAS: GOOG) | Oct. 13 | $8.74 | $7.64 | $8.74 | 11.3% |

IBM (NYS: IBM) | Oct. 17 | $3.21 | $2.82 | $3.09 | 2% |

VMware (NYS: VMW) | Oct. 17 | $0.50 | $0.39 | $0.55 | 17% |

Apple (NAS: AAPL) | Oct. 18 | $7.20 | $4.64 | $7.79 | 33.6% |

EMC (NYS: EMC) | Oct. 18 | $0.37 | $0.30 | $0.35 | 2.9% |

Intel (NAS: INTC) | Oct. 18 | $0.61 | $0.52 | $0.54 | 5.9% |

eBay (NAS: EBAY) | Oct. 19 | $0.48 | $0.40 | $0.48 | 4.3% |

Microsoft (NAS: MSFT) | Oct. 20 | $0.68 | $0.62 | $0.69 | 19% |

Nokia (NYS: NOK) | Oct. 20 | ($0.01) | $0.14 | $0.09 | 200% |

Baidu (NAS: BIDU) | Oct. 21 | $0.83 | $0.45 | $0.72 | 9.1% |

Texas Instruments (NYS: TXN) | Oct. 24 | $0.57 | $0.71 | $0.56 | 5.7% |

Netflix (NAS: NFLX) | Oct. 24 | $0.94 | $0.70 | $1.26 | 13.5% |

Amazon.com (NAS: AMZN) | Oct. 25 | $0.24 | $0.51 | $0.41 | 17.1% |

ARM Holdings (NAS: ARMH) | Oct. 25 | $0.13 | $0.10 | $0.14 | 16.7% |

Broadcom (NAS: BRCM) | Oct. 25 | $0.76 | $0.74 | $0.72 | 14.3% |

Qualcomm (NAS: QCOM) | Nov. 3 | $0.78 | $0.68 | $0.73 | 2.8% |

Activision Blizzard (NAS: ATVI) | Nov. 4 | $0.03 | $0.12 | $0.10 | 100% |

Cisco (NAS: CSCO) | Nov. 11 | $0.39 | $0.42 | $0.40 | 5.3% |

Salesforce.com (NYS: CRM) | Nov. 16 | $0.31 | $0.32 | $0.30 | 0% |

Dell (NAS: DELL) | Nov. 17 | $0.47 | $0.45 | $0.54 | 10.2% |

Hewlett-Packard (NYS: HPQ) | Nov. 22 | $1.13 | $1.33 | $1.10 | 0.9% |

Sources: Yahoo! Finance and S&P Capital IQ.

Across the board, it looks as if analysts expect year-over-year earnings to still be on the up and up -- although all's not rosy across the board for these 20 companies. Analysts anticipate quarter-to-quarter decreases for growth behemoths such as Apple, Netflix, and Amazon. Overall, they expect falling sequential earnings in eight of the companies here. However, that can be an indication of the state of affairs with the individual company -- Nokia, for instance -- as much as with the economy. IT earnings have grown by leaps and bounds since weathering the worst of the Great Recession, but with concerns over the dimming American recovery, expect the market to scrutinize this quarter's results pretty closely.

In investing, the best informed often enjoy the best results, so make sure to check back with The Fool to keep tabs on all the important earnings and investing related news. And if you want another great investing idea, The Motley Fool recently complied a free report detailing "The Only Stock You Need to Profit From the NEW Technology Revolution." It's completely free for our readers.

At the time thisarticle was published Andrew Tonner holds no positions in any of the companies mentioned in this article. The Motley Fool owns shares of Cisco Systems, Intel, Google, Texas Instruments, Microsoft, IBM, Qualcomm, Apple, EMC, and Activision Blizzard and has written calls on Activision Blizzard.Motley Fool newsletter serviceshave recommended buying shares of Cisco Systems, Baidu, Dell, Activision Blizzard, salesforce.com, Apple, eBay, Microsoft, Google, Intel, Netflix, VMware, and Amazon.com, creating a synthetic long position in Activision Blizzard, creating bull call spread positions in Apple and Microsoft, shorting salesforce.com, creating a bear put spread position in Netflix, and creating a diagonal call position in Intel. Try any of our Foolish newsletter servicesfree for 30 days. We Fools don't all hold the same opinions, but we all believe thatconsidering a diverse range of insightsmakes us better investors. The Motley Fool has adisclosure policy.

Copyright © 1995 - 2011 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.