Stocks Are a Good Investment Now; Here's Why

There are lots of ways to try to figure out if the stock market is over or undervalued. Market timing -- trying to get out at the top and in at the bottom -- is a fool's game. But that doesn't mean we can't try to take the general temperature of the market from time to time to inform our decision making.

Back in April, fellow Fool Jordan DiPietro wrote an excellent piece on why he thought the stock market might be overvalued by 44%. Since then the S&P 500 (INDEX: ^GSPC) is down about 14%.

Given that there's still a long way to reach Jordan's prediction, you'd think that I'd shy away from buying stocks now. But that's not the case at all. In fact, I now think the market is slightly undervalued. Read all the way to the end, and I'll offer you access to a report featuring five excellent stocks for this undervalued market.

But first, back to the macro picture...

Shiller index

As Jordan pointed out in his piece, "Yale economist Robert Shiller successfully called out the tech bubble in 2000 and forecast the housing bust in 2006. Now he's making another a dire prediction: The stock market could be overheated, and it's expensive relative to its historical valuations."

Usually, investors use the price-to-earnings ratio of the broader market as a barometer of how expensive stocks are. Currently, the S&P 500 is trading at 14 times earnings over the past 12 months, and the Dow Jones Industrial (INDEX: ^DJI) is at 12. Given that averages are usually around 15 or 16, this seems great.

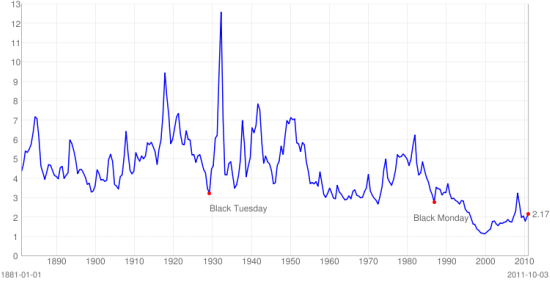

Not according to Shiller. Instead of just using the past 12 months to measure P/E, Shiller created a measure he dubbed the cyclically adjusted price-to-earnings ratio. In essence, CAPE takes into account the inflation-adjusted earnings of the past 10 years in order to smooth out the cyclicality of the market. Here's what the market's CAPE has looked like since 1881.

Source: www.multpl.com.

If you take all this data and compute it, the average CAPE over the past 130 years comes out to 16.41. With today's CAPE sitting at 19.3, the market still looks overheated to a tune of 17%. So why, looking at this data, do I still believe now is the time to buy stocks?

Psych 101

It all has to do with investor psychology. Back when the market was in its infancy, all the way up to the mid-1950s, stocks were judged far more on their dividend payouts than on their future earnings potential.

If you think about the businesses that were around then -- stalwarts in railroads, oil, and manufacturing -- this makes sense. Once infrastructure was built out, there were significant barriers to entry, and companies could dominate their industries for decades while throwing off copious amounts of cash. Shareholders -- who actually owned the companies -- demanded that cash, and received hefty dividend payouts as a result.

But take a look below at the historical dividend payout of the market, and you'll see something started happening around the mid-1950s that took payouts much further down.

Source: http://www.multpl.com/s-p-500-dividend-yield/.

I believe what happened was simple: Technology started changing the game. After World War II, a wave of developments swept across America's landscape.

New industries were formed, and companies decided to keep the cash they had on hand for future development instead of offering huge dividend payouts. Likewise, investors were willing to pay a hefty premium for future earnings potential, something they had been unwilling to do in the past.

Though not every company fulfilled its potential -- and investors in those companies lost even more for paying a heftier premium -- those companies that do fire on all cylinders reward investors for their investments.

Because CAPE takes the trailing 10 years into account, I went back and figured out what the mean CAPE has been since 1965 (10 years after the mid-'50s shift). The result: An average CAPE of 19.57. With today's reading at 18.58, that means the market is slightly undervalued -- by about 5% to be exact.

Go where the deals are

Taking this new metric into consideration, I went looking for stocks in the S&P 500 that offered value to long-term investors. By no means should you load up on any one company, but if you've been sitting on the sidelines while the stock market slides, here are some companies to consider getting your feet wet in.

I went looking for companies with P/Es less than 10, price-to-earnings growth less than one, and that are expected to grow earnings by at least 15% over the next year. Here's what I found:

Company | P/E | PEG | Expected EPS Growth |

|---|---|---|---|

Micron (NAS: MU) | 7.0 | 0.67 | 81% |

Hartford Financial (NYS: HIG) | 4.2 | 0.47 | 36% |

Weyerhaeuser (NYS: WY) | 7.9 | 0.88 | 117% |

Advanced Micro Devices (NYS: AMD) | 4.2 | 0.47 | 36% |

First Solar (NAS: FSLR) | 9.9 | 0.49 | 20% |

Source: www.finviz.com.

These options represent attractively priced technology companies (Micron and AMD), an insurance company (Hartford) that -- along with the rest of its industry -- has been hit hard as of late, an interesting real estate play that owns the rights to forests and their lumber (Weyerhaeuser) that has fallen about 40% in the past six months, and a leading solar company whose industry has dropped off a cliff lately.

By no means am I suggesting that you should go out and buy these stocks right away. These are just my thoughts, based on a very basic screen that I ran on S&P 500 companies. You should always do your own research before buying.

If you'd like five more ideas that come from more than just a simple screen, I suggest you check out our special free report: "5 Stocks the Motley Fool Owns -- And You Should Too."

A group of our top analysts hand-picked these stocks. The Motley Fool has so much faith in these stocks, that we've actually bought them for our company's portfolio. You can get the report today, absolutely free!

At the time thisarticle was published Fool contributorBrian Stoffeldoes not own shares in any company mentioned. You can follow him on Twitter at@TMFStoffel. The Motley Fool owns shares of First Solar.Motley Fool newsletter serviceshave recommended buying shares of First Solar. Try any of our Foolish newsletter servicesfree for 30 days. We Fools may not all hold the same opinions, but we all believe thatconsidering a diverse range of insightsmakes us better investors. The Motley Fool has adisclosure policy.

Copyright © 1995 - 2011 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.