A Brief History of Procter & Gamble's Returns

Despite constant attempts by analysts and the media to complicate the basics of investing, there are really only three ways a stock can create value for its shareholders:

Dividends.

Earnings growth.

Changes in valuation multiples.

In this series, we drill down on one company's returns to see how each of those three has played a role over the past decade. Step on up, Procter & Gamble (NAS: PG) .

Over the past 10 years, P&G has returned a total of 126% to shareholders. How'd it get there?

Dividends accounted for a lot of it. Without dividends, P&G returned 78% over the past decade.

Earnings growth over this period has been substantial. Over the past 10 years, earnings per share have grown at an average of 12.2% per year -- well above the overall market average. Considering the global economy has suffered not one, but two shocks over the past decade, this is truly a remarkable performance.

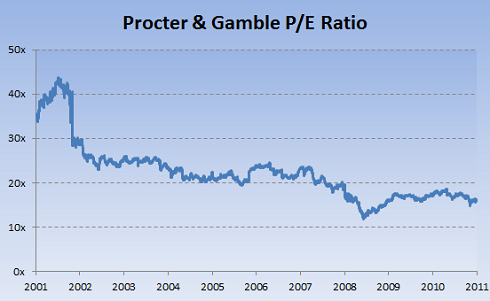

Yet shareholder returns haven't been close to what you'd expect from a company whose earnings have grown so mightily over the past decade. Answering why lies in this chart:

Source: Capital IQ, a division of Standard & Poor's.

P&G's valuation multiple has dropped consistently, and sharply, for most of the past 10 years. Part of the reason is that 10 years ago was the tail end of the dot-com bubble, when most stocks were priced for perfection. But there's another dynamic affecting how the market values the company's earnings. In the past, P&G carved out a niche supplying branded, high-end consumer goods to a growing middle class that valued prestige. After the financial crisis reshaped consumer spending habits, competition from generic products supplied by companies like Costco (NAS: COST) and Safeway (NYS: SWY) eroded some of P&G's moat and put pressure on margins. It is still one of the highest-quality companies in the world, but P&G's earnings aren't quite as valuable as the market once thought. And it shows.

Why is this stuff worth paying attention to? It's important to know not only how much a stock has returned, but where those returns came from. Sometimes earnings grow, but the market isn't willing to pay as much for those earnings. Sometimes earnings fall, but the market bids shares higher anyway. Sometimes both earnings and earnings multiples stay flat, but a company generates returns through dividends. Sometimes everything works together, and returns surge. Sometimes nothing works and they crash. All tell a different story about the state of a company. Not knowing why something happened can be just as dangerous as not knowing that something happened at all.

Add Procter & Gamble to My Watchlist.

At the time thisarticle was published Fool contributorMorgan Houselowns shares of Procter & Gamble. Follow him on Twitter, where he goes by@TMFHousel. The Motley Fool owns shares of Costco Wholesale.Motley Fool newsletter serviceshave recommended buying shares of Procter & Gamble and Costco Wholesale. Try any of our Foolish newsletter servicesfree for 30 days. We Fools don't all hold the same opinions, but we all believe thatconsidering a diverse range of insightsmakes us better investors. The Motley Fool has adisclosure policy.

Copyright © 1995 - 2011 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.