The Extraordinary Power of Verizon's Dividends

Wharton professor Jeremy Siegel shared a wonderful discovery in his book The Future for Investors: The greatest long-term returns typically don't come from the most innovative companies, or even companies with the highest earnings growth. They come from companies that happen to crank out dividends year after year. Simply put, since the 1950s, "the portfolios with higher dividend yields offered investors higher returns."

Market commentary regularly centers around price gyrations, yet dividends have historically accounted for more than half of total returns.

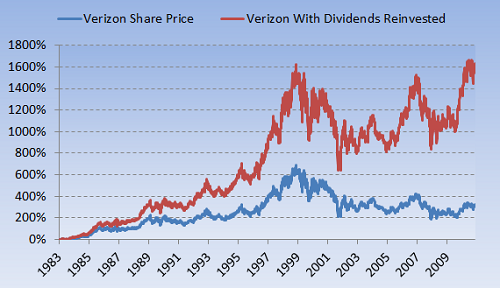

Reinvest those dividends, and the gains get even greater. Take Verizon (NYS: VZ) , for example. Since the mid-1980s, the company's (and its predecessors') share price has increased 323%. But add in reinvested dividends, and total returns jump to more than 1,600%:

Source: Capital IQ, a division of Standard & Poor's.

There's no ambiguity here: Over time, Verizon's share appreciation alone has paled in importance to the power of its reinvested dividends. The results are similar for AT&T (NYS: T) and CenturyLink (NYS: CTL) ; reinvested dividends skew both companies' total returns dramatically higher. If you're a long-term shareholder, don't worry about daily share wobbles. Devote your attention those dividend payouts, and your commitment to reinvest them.

And how do Verizon's dividends look? At 5.4%, its yield is among the highest you'll find in large-cap stocks. There is a sense of unpleasantness, to put it lightly, in the fact that Verizon's main asset, Verizon Wireless, is co-owned with Vodafone. The Verizon parent company (which is what is sold on the open market) relies to some extent on dividends from Verizon Wireless to keep its cash levels adequate. Alas, those dividends are sporadic. Verizon Wireless recently announced a $10 billion dividend to its two parents, which should net the Verizon parent company some $5.5 billion. What happens from there, however, isn't crystal clear. "We intend to maintain a strong balance sheet and a very competitive dividend, as this is a critical component of shareholder value creation," the Verizon parent company said on a recent conference call. There's probably good truth to that. Dividends have become such an integral part of telecom stocks that management will jump through hoops to keep them going. But there is risk in every investment. And with Verizon, ownership structure is one you have to think about.

To earn the greatest returns, get your priorities straight. What the market does is less important than what your company earns. What your company earns is less important than how much it pays out in dividends. And what it pays out in dividends is less important than whether you reinvest those dividends.

Add Verizon to My Watchlist.

At the time thisarticle was published Fool contributorMorgan Houselowns shares of Verizon and AT&T. Follow him on Twitter, where he goes by @TMFHousel.Motley Fool newsletter serviceshave recommended buying shares of AT&T and Vodafone Group. Try any of our Foolish newsletter services free for 30 days. We Fools don't all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2011 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.