Is Apache Generating Enough Returns on Invested Capital?

Investors expect good returns. The more cash you get back for the amount you invested, the better your investment is. The same is true for the companies you invest in. Let's take a look at how investors can determine whether a business is capable of generating superior returns.

The metric that matters: return on invested capital

A growing bottom line does not guarantee good returns. More than earnings growth itself, it pays to find out how much has been invested into the business in order to generate that growth. This is where return on invested capital (ROIC) comes into play.

ROIC looks at earnings power relative to how much capital is tied up in a business. While a company's earnings may register growth, the return on invested capital might be declining. In other words, for every dollar of income generated, the company has to plough more and more cash into the business over time. This is a warning sign. Unfortunately, investors fall into the trap of putting cash into companies that venture into less profitable projects. The result: It requires more cash for the company to generate the same returns.

Oil and gas companies have been through some tough times in the past five years. Volatile energy prices have played a role in causing fluctuating bottom lines. But the fact is, these companies have sunk a lot of cash into investments by raising debt and by raising equity. It makes economic sense to find out whether these investments are generating returns that investors expect. Today, we will see how Apache (NYS: APA) stacks up.

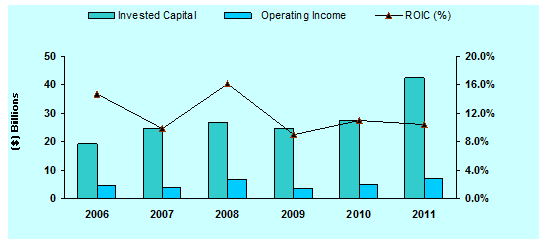

This is how invested capital, operating income, and ROIC stack up for the past six years:

Source: Capital IQ, a Standard & Poor's company. ROIC is author's calculation. All data presented here are for a 12-month period ending June 30 of the corresponding year.

Invested capital has shot up by 120% since 2006, while ROIC has generally been stagnant during this period, except for a spike in 2008. In the past 12 months, capital employed has grown much faster than operating income, which sent the returns lower. This is definitely a yellow flag.

Operating income, though increasing in the past three years, hasn't been able to keep up with invested capital. Apache's management should probably work harder to increase shareholder returns.

However, looking at Apache alongside a few of its peers shows that Apache's returns don't look too bad.

Company | Return on Invested Capital (TTM) | Return on Equity (TTM) |

|---|---|---|

Apache | 10.4% | 17.4% |

Anadarko Petroleum (NYS: APC) | 4.4% | 4.2% |

Suncor Energy (NYS: SU) | 5.6% | 8.3% |

Imperial Oil (NYS: IMO) | 13.2% | 23.9% |

Source: Capital IQ, a Standard & Poor's company; ROIC is author's calculation; TTM = trailing 12 months.

Return compared to cost

Unfortunately, ROIC alone can't tell you how well a company is operating. Invested capital comes at a cost. Investors should check whether returns on invested capital exceed that cost. The weighted average cost of capital (WACC) tells us exactly that, since both debt and equity are used for financing operations. Debt-to-equity currently stands at 29.4%.

Apache's after-tax interest expense or cost of debt stands at $137 million for the trailing-12 -month period, which is less than 2% of its total debt. Expecting a 12% return from equity (beating the S&P 500's 10% average historical return) is a fair expectation for this company.

Using this data, WACC adds up to 9%. This is less than the ROIC of 10.4%, which is what I'm looking for. Apache has been able to build on shareholder value. The company has been investing in projects which generate returns above the rate investors expect.

Foolish bottom line

Exploration and production companies have sunk a lot of cash over the past few years into investments on which they are yet to fully realize gains. Investments in the Kitimat LNG facility, in addition to the Pacific Trail Pipelines partnership, have huge potential to increase returns for Apache. With natural gas demand widely expected to shoot up, LNG facilities could be the next hunting ground for E&P companies.

Keep an eye on Apache by adding the stock to your free Fool watchlist.

At the time thisarticle was published Fool contributor Isac Simon does not own shares of any of the companies mentioned in this article.Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2011 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.