Accenture: Creating or Destroying Value?

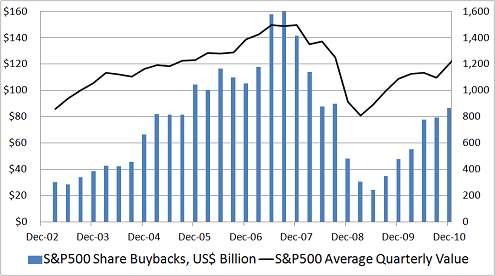

I'm highly skeptical about the economic value of most share repurchase programs. To see why, look at the following graph of the total buyback dollar amount for the companies in the S&P 500, compared to the average price of the index on a quarterly basis:

Source: Standard & Poor's.

Share buybacks for the S&P 500 accelerated in the second half of 2004, culminating in a sharp spike during the first two quarters of 2007 -- just as the stock market was peaking. Conversely, when stocks traded at bargain prices during the worst of the crisis, share buybacks dried up. Then, as stocks became more expensive during the rally that began in March 2009, companies once more became happy to step up the dollar amounts spent on share repurchases.

Still, not all buyback programs hurt shareholders. In order to praise smart capital allocators and shame those who fritter away shareholder capital, I've decided to evaluate individual share repurchase programs. Today, I'm looking at the new program established by business services firm Accenture (NYS: ACN) .

How much, for how long?

The $5 billion increase in Accenture's share buyback authorization raises the total outstanding to approximately $6 billion. The company is placing no restrictions on when it will buy shares, or in what amounts.

How cheap is the stock?

Accenture's announcement doesn't specifically mention the share price as one of factors that will determine their ability to spend their authorization. That's a shame because the relationship between price paid and intrinsic value will determine whether the share repurchases are compounding or destroying shareholder wealth. Just how cheap (or expensive) are the shares right now? Based on its price-to-earnings ratio, Accenture trades toward the top of the pack with regard to four of its peers:

Cognizant Technology Solutions (NAS: CTSH) | 24.5 |

Accenture | 17.3 |

Amdocs (NYS: DOX) | 14.8 |

International Business Machines (NYS: IBM) | 14.6 |

Computer Sciences (NYS: CSC) | 5.8 |

Source: Capital IQ, a division of Standard & Poor's.

Is this a smart use of shareholder capital?

Accenture's price-to-earnings multiple is in the top half compared to the company's industry peers and the companies in the S&P 500 and in the middle of the range relative to its own five-year history. With shares trading at 14.3 times its earnings-per-share estimate for the next 12 months, the share buyback program looks like a decent use of shareholder capital at these prices. IBM shares also look interesting and Computer Sciences' even more so. It's worth tracking the shares of all three, and you can do that with our free application, My Watchlist.

Add Accenture to My Watchlist.

Add International Business Machines to My Watchlist.

Add Computer Sciences to My Watchlist.

At the time thisarticle was published Fool contributorAlex Dumortierholds no position in any company mentioned.Click hereto see his holdings and a short bio. You can follow himon Twitter. The Motley Fool owns shares of International Business Machines and Computer Sciences.Motley Fool newsletter serviceshave recommended buying shares of Accenture. Try any of our Foolish newsletter servicesfree for 30 days. We Fools may not all hold the same opinions, but we all believe thatconsidering a diverse range of insightsmakes us better investors. The Motley Fool has adisclosure policy.

Copyright © 1995 - 2011 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.