Is Buffett's Berkshire Buy a Bearish Sign?

Warren Buffett's Berkshire Hathaway (NYS: BRK.A) (NYS: BRK.B) is doing something it's never done before: It's buying back its own shares.

I think the move is great news for Berkshire shareholders. As my fellow Fool Morgan Housel noted, prior to the buyout-announcement pop, Berkshire shares were trading at a mere 1.02 times book value, the cheapest level they've seen in decades. According to Bloomberg, the stock has traded at an average book value multiple of 1.55 since 2000.

But an interesting question is whether this is a bearish sign for the rest of the market. If Buffett is opting to buy back Berkshire stock -- something he's never done before -- rather than sink the same cash into shares of other publicly traded companies, does this mean that he doesn't see bargains elsewhere?

Probably not

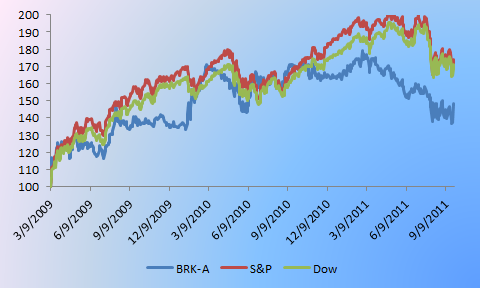

I would wager that this is much more of a reflection on the cheapness of Berkshire's stock than a view t hat there aren't bargains in the rest of the market. Though Berkshire's stock has recovered 48% since the market's low in March of 2009, it's fallen well short of the gains on both the S&P 500 and larger-cap-focused Dow Jones.

Source: Yahoo! Finance.

Berkshire's business has hardly flat-lined since that point, but the stock's valuation has gone almost nowhere. At its lowest point in 2009, Berkshire's stock traded at a price-to-book multiple of 0.97, so prior to the buyback announcement, we could say that the stock was still trading at crisis levels.

The devil's advocate may say, "Yes, but when Berkshire was trading at these levels during the crisis, Buffett chose to put his money into companies like Goldman Sachs and GE (NYS: GE) rather than Berkshire, so why the change now?"

That's actually pretty easy to address. Though Berkshire's stock got battered during the crisis, other stocks took an even harder hit. At their respective low points, Goldman and GE saw price-to-book value multiples of 0.48 and 0.67, respectively. Not only that, but because of the paucity of funding sources at the time, Buffett was able to get sweetheart deals on both of those investments that gave Berkshire preferred stock, fat dividends, and warrants to boot.

It's not like Buffett isn't buying elsewhere

Surmising that Buffett doesn't see bargains outside of Berkshire would be easier if he wasn't also making other non-Berkshire buys. Bloomberg cited Buffett as saying that he spent more on stocks on Aug. 8 than at any other point during the year. When talking to Fortune a few days after that, Buffett quipped: "The lower things go, the more I buy. We are in the business of buying."

We won't know for another month or so what exactly Buffett was buying in August, but we do know that he added to Berkshire's portfolio through the first half of the year, including boosting his huge Wells Fargo stake and adding to his position in British grocer Tesco. And of course we can't forget the preferred investment he made in Bank of America (NYS: BAC) .

Value, value everywhere...

Bloomberg ran the headline "Buffett Buyback Shows S&P 500 Passes Berkshire Value Test," which was rather confusing since the article noted that the index would have to fall around 40% for its book value multiple to match Buffett's Berkshire target.

But even if the overall index doesn't have a Berkshire-esque valuation, there are plenty of individual stocks that are as cheap, if not cheaper. Wells Fargo currently trades right around its book value, while JPMorgan Chase and Bank of America have multiples of 0.71 and 0.33, respectively. Insurers MetLife (NYS: MET) and WellPoint change hands at book value multiples of 0.57 and 0.99, respectively, while asset manager BlackRock is at 1.1.

And while book value multiples are great for valuing financial businesses, they can be less useful when looking at other types of businesses. From a price-to-earnings perspective, there are plenty of other bargains to be found including Microsoft, Chevron (NYS: CVX) , and AT&T (NYS: T) , which sport P/E multiples of 9.5, 8, and 8.6.

No called strikes

Looking back over Warren Buffett's history, it's clear that he doesn't take action for action's sake. If there are no bargains available, he's perfectly comfortable sitting on his hands and letting Berkshire's cash wait around. So if you're concerned that Buffett is buying back Berkshire stock simply because he doesn't see anything else worthwhile out there, don't be. This simply means that Berkshire's stock is a screaming bargain.

Want to keep a closer eye on Berkshire Hathaway and what Warren Buffett is doing? Add the stock to your Foolish watchlist. And if you don't have a watchlist yet, you're in luck -- you can start one up right now for free.

At the time thisarticle was published The Motley Fool owns shares of Berkshire Hathaway, Bank of America, Microsoft, and JPMorgan Chase. The Fool owns shares of and has created a ratio put spread position on Wells Fargo.Motley Fool newsletter serviceshave recommended buying shares of Berkshire Hathaway, Chevron, AT&T, BlackRock, WellPoint, and Microsoft.Motley Fool newsletter serviceshave recommended creating a bull call spread position in Microsoft. Try any of our Foolish newsletter servicesfree for 30 days. We Fools may not all hold the same opinions, but we all believe thatconsidering a diverse range of insightsmakes us better investors. The Motley Fool has adisclosure policy.Fool contributorMatt Koppenhefferowns shares of Berkshire Hathaway, Bank of America, Microsoft, AT&T, and Chevron, but does not have a financial interest in any of the other companies mentioned. You can check out what Matt is keeping an eye on by visiting hisCAPS portfolio, or you can follow Matt on Twitter@KoppTheFoolorFacebook. The Fool'sdisclosure policyprefers dividends over a sharp stick in the eye.

Copyright © 1995 - 2011 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.