Edwards Lifesciences: Creating or Destroying Value?

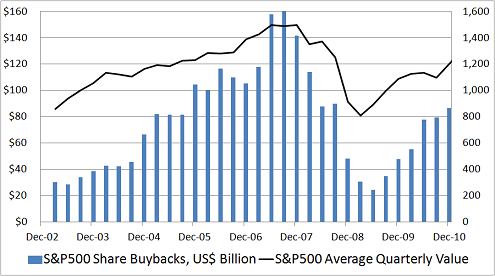

If you've read "U.S.A., Inc.: Another Historic Misallocation," you know that I'm highly skeptical regarding the economic value of most share repurchase programs. The reason? Take a look at the following graph of the total buyback dollar amount for the companies in the S&P 500 and the average price of the index, on a quarterly basis:

Source: Standard & Poor's.

Share buybacks for the S&P 500 accelerated in the second half of 2004, capped off with a sharp spike during the first two quarters of 2007 -- just as the stock market was peaking. Conversely, during the worst of the crisis -- when stocks were at bargain prices -- share buybacks dried up. Then, as stocks became more expensive during the rally that began in March 2009, companies were happy to step up the dollar amounts spent on share repurchases.

Still, not all buyback programs hurt shareholders. In order to praise smart capital allocators and shame those who fritter away shareholder capital, I've decided to evaluate individual share repurchase programs. Today, I'm looking at the new program established by medical device maker Edwards Lifesciences (NYS: EW) .

How much, for how long?

Edwards Lifesciences' new buyback program allows the company to buy up to $500 million of shares on top of the approximately $240 million remaining under the $500 million authorization initiated in February 2010. Edwards expects to buy roughly $100 million of shares in the third quarter.

How cheap is the stock?

Edwards Lifesciences' announcement doesn't specifically mention share price as one of the factors that will determine their ability to spend their authorization. That's a shame, because the relationship between price paid and intrinsic value will determine whether the share repurchases are creating or destroying shareholder wealth. Just how cheap (or expensive) are the shares right now? Based on its price-to-earnings ratio, Edwards Lifesciences trades at the top of the pack with regard to four of its peers:

Company | Forward P/E |

|---|---|

Edwards Lifesciences | 33.2 |

Intuitive Surgical (NAS: ISRG) | 30.6 |

ZOLL Medical (NAS: ZOLL) | 21.6 |

Boston Scientific (NYS: BSX) | 13.8 |

Medtronic (NYS: MDT) | 9.7 |

Source: Capital IQ, a division of Standard & Poor's.

Is this a smart use of shareholder capital?

Edwards Lifesciences' price-to-earnings multiple is in the top quintile compared to its industry peers, the companies in the S&P 500, and its own five-year history. With shares trading at 33.2 times its earnings-per-share estimate for the next 12 months, the share buyback program looks like a poor use of shareholder capital at these prices. At the bottom of the table, however, Boston Scientific and Medtronic both look attractive -- it's worth tracking their shares and you can do that with our free application, My Watchlist.

Companies can't waste the cash they return to shareholders. The Motley Fool's best analysts have identified13 High-Yielding Stocks to Buy Today.

At the time thisarticle was published Fool contributorAlex Dumortierholds no position in any company mentioned.Click hereto see his holdings and a short bio. You can follow himon Twitter.The Motley Fool owns shares of Medtronic.Motley Fool newsletter serviceshave recommended buying shares of Intuitive Surgical. Try any of our Foolish newsletter servicesfree for 30 days. We Fools may not all hold the same opinions, but we all believe thatconsidering a diverse range of insightsmakes us better investors. The Motley Fool has adisclosure policy.

Copyright © 1995 - 2011 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.