1 Refreshing Stock That Has What This Fool Wants

After learning from my worst investment decision, I am developing a list of companies that I will be watching over the next six months. I hope to find 18-20 companies that would make great additions to my -- or anyone's -- portfolio, and eventually pare the list down to 8-12 companies. You can see my first choice here.

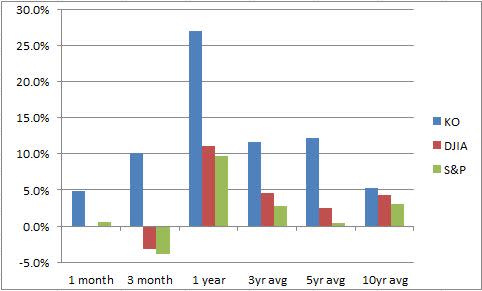

Along the same line of thinking as my first choice, Waste Management, I have found another company with a fairly sustainable moat. Coca-Cola (NYS: KO) has made a business of selling sugary, nonalcoholic beverage concentrates for more than 125 years. Luckily for us, they are really good at what they do, and their stock performance over the years has borne this out, beating the returns of both the DJIA (INDEX: ^DJI) and S&P 500 (INDEX: ^SPX) over the past 10 years.

Source: Morningstar.com.

Sell that sugar water!

Coke knows what it is good at, focusing primarily on the sweet drinks that generations have grown up drinking. Contrast this with leading competitor PepsiCo (NYS: PEP) , whose Frito-Lay and other assorted food items sidetrack it a bit from the business of peddling sugar water to the masses.

Coke products are consumed at the rate of 1.6 billion drinks per day in more than 200 countries. As expected, nearly 70% of its revenues in 2010 came from outside the United States. Its three fastest-growing business segments outside of North America -- Eurasia and Africa, Latin America, and the Pacific -- accounted for 34% of total revenues and almost 49% of revenue outside of the United States.

That is not to say Coke is struggling in the U.S. Revenue in the United States grew 33% from 2009 to 2010, outpacing all other segments of the company. This was due to the acquisition of the North American bottling operations of Coca-Cola Enterprises. Coke produces the top two soda brands in the U.S., and four of the top 10. While PepsiCo also has four brands in the top 10, my highly unscientific average rating has Coke clocking in with a 4.75 average rank, with Pepsi at 5.5, and third-place Dr Pepper Snapple (NYS: DPS) bringing up the rear at 7.

Rising costs looming?

With the 2010 acquisition of Coca-Cola Enterprises' North American bottling operations, Coke's pension expense has increased from $176 million to an estimated $240 million for 2011. Rising pension costs across the country have caused many businesses to have issues, including the U.S. Postal Service. While this expense could be viewed as pocket change for a company as large as Coke, anytime expenses increase, profitability suffers. Throw in the assumption of $7.9 billion of CCE's debt, and Coke is experiencing higher interest expense. In the long run, Coke expects the acquisition of CCE to pay dividends for the company in the form of lower bottling costs.

Distribute, acquire, repeat

One positive of the CCE acquisition was the assumption of a distribution deal with Dr Pepper Snapple. Previously, CCE was the distributor of Dr Pepper Snapple's brands in North America. Coca-Cola also will include Dr Pepper and Diet Dr Pepper in its fountain dispensers in certain outlets throughout the U.S. This agreement is for the next 20 years, placing two more top 10 soda brands with Coke's offerings.

Other opportunities for growth could be found in the acquisition of smaller brands. Coca-Cola has an extensive history of acquiring various brands. It purchased Minute Maid in 1960, Barq's Root Beer in 1995, Odwalla fruit juice in 2001 and Fuze Beverage in 2007. Attempts to acquire Chinese juice maker Huiyuan Juice Group were thwarted by the Chinese government on fears that it would give Coke a juice monopoly in China.

Another avenue for growth could be in energy drinks, currently a small part of Coca-Cola's product stable. It sells its own energy drinks under the Full Throttle and NOS brands, but trails leaders Red Bull, Hansen Natural's (NAS: HANS) Monster, Rockstar, and PepsiCo's AMP Energy.

It really isn't healthy

Like any company that makes its money peddling unhealthy products, the growing health consciousness of this country and others may slow down the flow of Coke in the future. The company also acknowledges potential problems caused by scarcity or poor quality of water, its main ingredient.

Meanwhile, SodaStream International (NAS: SODA) targets those who want to make their own soda pop at home. SodaStream deserves some respect, but will probably never replace people's taste for their favorite soda brand.

What do you think?

I didn't even talk about how Coca-Cola is an outstanding dividend stock, but I like the company for more than its yield. It is a company that lives up to its ticker and KO's the competition. That's why I am adding it to My Watchlist to keep an eye on the company over the next few months. I encourage you to do the same. Are there other companies you think I should keep my eye on? Let me know in the comments below.

At the time thisarticle was published Foolish contributor Robert Eberhard prefers Diet Dr Pepper as a drink, but likes Coca-Cola better as a stock. Follow him on Twitter @GuruEbby. The Motley Fool owns shares of Coca-Cola, Waste Management, and PepsiCo. Motley Fool newsletter services have recommended buying shares of Waste Management, PepsiCo, Coca-Cola, Hansen Natural, and SodaStream. Motley Fool newsletter services have recommended creating a diagonal call position in PepsiCo. Motley Fool newsletter services have recommended creating a write covered strangle position in Waste Management. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2011 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.