The Least Exciting Play That Crushes the Market

"There's a group of guys out here who don't worry about cause and effect because there is no real effect."

-- Anonymous NASCAR driver in ESPN the Magazine

The unnamed racecar driver was talking about advances in car safety that make some drivers feel invincible. The result is excessive risk taking that eventually leads to tragedy.

Many of us investors also felt a false sense of security as the market has risen sharply for the past two years. But our riskier positions are feeling the consequences today in a declining market.

Of the 3,424 stocks sized above $200 million, more than 1,000 are down more than 20% since the market top in July. That's a lot of stocks feeling a lot of pain!

However, hidden in the rubble is a redemption story for an area of the market that so many pooh-poohed in good times. I'll show you the story in three pictures and then reveal one stock looking especially good today.

The tortoise crushing the hare

Like reckless drivers shielded by better safety equipment and subprime lenders profiting in a rising housing market, ill-advised investments can look great for short periods of time, bringing massive, make-your-neighbors-and-coworkers-jealous-type of returns when the stock market's up. A naive observer would assume the more debt and the less profit a company has, the better the investment. Ditto for companies with more talk of the future than walk in the past.

Meanwhile, the companies that have made investors rich with decades of steady, unyielding business excellence looked shabby in comparison. Especially those that offered no exciting promise of the next new thing -- the ones that would be chugging along just fine if the Internet were never invented.

Specifically, I'm talking about companies just like these:

Coca-Cola (NYS: KO) and PepsiCo (NYS: PEP) -- A virtual beverage duopoly with brand power that can withstand threats from upstarts.

Colgate-Palmolive (NYS: CL) and Procter & Gamble (NYS: PG) -- Between them, their brands are all over our houses, from kitchens to bathrooms to the laundry room.

Johnson & Johnson (NYS: JNJ) -- The one-stop "health-care mutual fund" with strong brands in medical devices, pharmaceuticals, and consumer goods.

McDonald's (NYS: MCD) -- The Golden Arches is a model of consistency in all respects.

Wal-Mart (NYS: WMT) -- The preeminent one-stop-shop discount retailer.

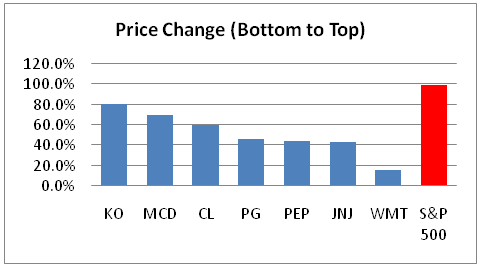

Sure, their stocks went up during the market climb from March 2009 to July 2011. But they lagged the market's 98.8% return. Most seriously so. Take a look.

Capital IQ, a division of Standard & Poor's.

While other stocks were doubling up (or more), not one of these stocks beat the S&P 500 coming out of the market bottom. Heck, Wal-Mart barely beat zero.

But the brilliance of these stocks isn't in their performance during good times. Like a trusted friend, it's during the bad times when these stocks shine.

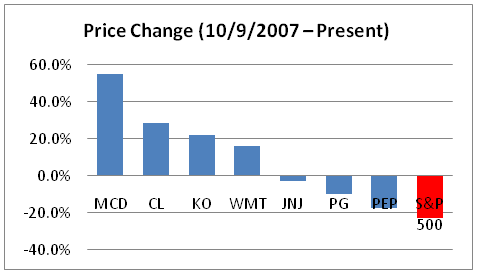

Let's look back to their performance from the market peak in October 2007 to the bottom in March 2009, as the S&P 500 lost 56.8%.

Capital IQ, a division of Standard & Poor's.

All of a sudden, Wal-Mart's barely positive performance is a warm blanket rather than a cold shower. Not just Wal-Mart. During the scary financial crisis, each of these stocks outperformed the S&P 500.

They have also fared well during the recent market turbulence. Putting all this together, the picture below shows us how slow and steady does indeed win the race.

Capital IQ, a division of Standard & Poor's.

I've broken down a short time period, but these brand-oriented companies have been doing their thing for decades upon decades. The song remains the same: Newer, shinier companies come and go while these seven (and a handful of similarly positioned companies) methodically beat the market with timeless offerings.

The further back we go, the more dominant these companies are shown to be. Especially when you factor in dividends. As Warren Buffett put it, "Time is the friend of the wonderful company, the enemy of the mediocre." These are wonderful companies, which is why Buffett is invested heavily in four of the seven stocks himself (Coke, J&J, P&G, and Wal-Mart).

The most attractive stock right now

Ironically, the problem we face as investors looking to buy stock in these businesses is they are so steady. They tend to be about half as volatile as the market, so finding them at deep value prices is rare. On the positive side, they're rarely wildly overpriced, either.

Looking at these stocks today, there's a strong case for Wal-Mart being the most discounted. Wal-Mart is trading for just 11 times trailing earnings because of stagnating domestic growth and online competitive threats. However, it's because of its international prospects that Tim Hanson recommended it in our Global Gains newsletter: "Don't let Wal-Mart's domestic roots fool you: This is a global growth story and the perfect addition to any global portfolio ... "

Wal-Mart is the most attractively priced now, but each of these consumer-focused dominators is a great company to patiently add to just about any portfolio. In addition, I've written about one more dominant company in a recent Motley Fool free report. The company charges a premium and still manages to capture a whopping 50% market share. That's brand dominance that rivals Coca-Cola's! For the name of the company, along with four favorites from my fellow analysts, click here -- it's absolutely free.

At the time thisarticle was published Fool contributorAnand Chokkaveluowns shares of McDonald's and Johnson & Johnson, but he holds no other position in any company mentioned. Writing this article reminds him that simple deserves a premium to complex. The Motley Fool owns shares of PepsiCo, Johnson & Johnson, Wal-Mart Stores, and Coca-Cola.Motley Fool newsletter serviceshave recommended buying shares of Coca-Cola, Johnson & Johnson, McDonald's, PepsiCo, Wal-Mart Stores, and Procter & Gamble.Motley Fool newsletter serviceshave recommended creating a diagonal call position in PepsiCo., Johnson & Johnson, and Wal-Mart Stores. We Fools may not all hold the same opinions, but we all believe thatconsidering a diverse range of insightsmakes us better investors. The Motley Fool has adisclosure policy.

Copyright © 1995 - 2011 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.