Are Gold Prices Really Rising?

The gold bubble debate is reaching a fevered pitch. Many bubble believers argue that yellow-metal mania is creating a speculative bubble. Many gold believers say no such speculative bubble exists. And furthermore, gold prices aren't really rising; the value of the dollar is declining.

What's speculation got to do with it?

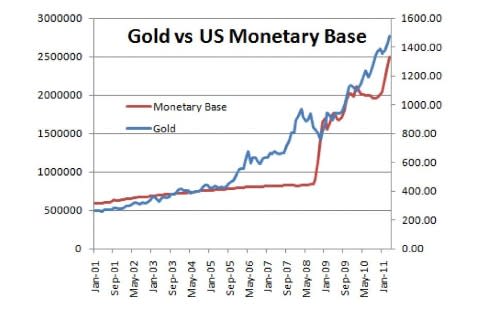

Gold bulls may be onto something. As illustrated below, gold prices steadily tracked the amount of money in circulation over the past decade.

An increase in the monetary base dilutes the dollar; as a result, the price of gold (and everything else) has increased. In other words, speculation has little to do with the recent rise in gold prices.

Barrick Gold's (NYS: ABX) CEO offers more evidence for a "dollar decline theory" by pointing out that gold has not appreciated disproportionately to other commodities during the past decade.

Eric Sprott, manager of Sprott Physical Gold Trust (NYS: PHYS) , also rebuts the speculative stampede theory by pointing out that a mere 0.75% of all financial assets are in gold.

The next chapter in the gold debate

Many believe further expansion of the monetary base (QE3) is coming. If the gold bulls are right, this will likely cause an increase in the price of gold, assuming the price has not been bid up in expectation of more dollar debasement.

Investors looking to capitalize on the possibility of more money being printed should consider any of the aforementioned investments as well as established gold miners like Newmont Mining (NYS: NEM) , Kinross Gold (NYS: KGC) , and Yamana Gold (NYS: AUY) , to name a few.

The bottom line

No one can say with certainty if the gold rush will continue or what is the root cause of the rise in gold prices. However, allocating a portion of your portfolio to gold could prove to be a prudent move.

Add Sprott Physical Gold Trust ETV to My Watchlist.

Add Newmont Mining to My Watchlist.

Add Kinross Gold to My Watchlist.

Add Yamana Gold to My Watchlist.

Add Barrick Gold to My Watchlist.

At the time thisarticle was published Fool contributor Adam J. Crawford does not own shares of any company mentioned in this article. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2011 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.