The Extraordinary Power of Diageo's Dividends

I took my first investing class as a teenager, and one moment stands out in my memory. A fellow student asked the instructor, a stockbroker, about dividends.

"Dividends?" he asked. "I'm trying to make my clients wealthy. You don't do that waiting for tiny checks in the mailbox every quarter."

Even then, I had enough horse sense to know he was wrong. Paying attention to dividends is exactly how you become wealthy over time.

Wharton professor Jeremy Siegel made a wonderful discovery in his book The Future for Investors. The greatest long-term returns typically don't come from the most innovative companies, or even companies with the highest earnings growth. They come from companies that happen to crank out dividends year after year. Simply put, since the 1950s, "the portfolios with higher dividend yields offered investors higher returns."

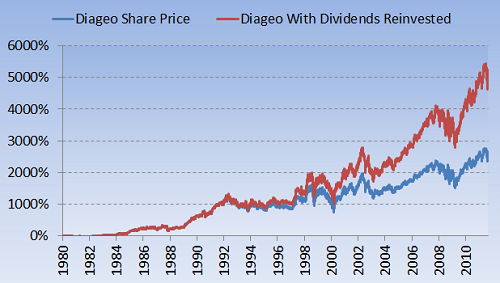

Take Diageo (NYS: DEO) , for example. Since the 1980s, the company's share price has increased 2,500%. But add in reinvested dividends, and total returns double to over 5,000%:

Source: Capital IQ, a division of Standard & Poor's.

The results are similar for others in the beverage space, like Coca-Cola (NYS: KO) and PepsiCo (NYS: PEP) ; reinvested dividends skew both companies' total returns dramatically higher. If you're a long-term shareholder, don't worry about daily share wobbles. Devote your attention to those dividend payouts and your commitment to reinvest them.

And how do Diageo's dividends look? At 3.3%, its yield is far above the market average. The company has paid a dividend every year since 1998. Over the past five years, dividends have used up an average of 60% of free cash flow. While that's not low, it's a manageable payout ratio that helps promote above-average dividend returns going forward.

To earn the greatest returns, get your priorities straight. What the market does is less important than what your company earns. What your company earns is less important than how much it pays out in dividends. And what it pays out in dividends is less important than whether you reinvest those dividends.

Add Diageo to My Watchlist.

At the time thisarticle was published Fool contributorMorgan Houseldoesn't own shares in any of the companies mentioned in this article. Follow him on Twitter @TMFHousel.The Motley Fool owns shares of Diageo, PepsiCo, and Coca-Cola. Motley Fool newsletter services have recommended buying shares of Diageo, PepsiCo, and Coca-Cola, as well as creating a diagonal call position in PepsiCo. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2011 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.