Is Annaly Capital a Buffett Stock?

As the world's third-richest person and most celebrated investor, Warren Buffett attracts a lot of attention. Thousands track his investments and try to glean what they can from his thinking processes.

While we can't know for sure whether Buffett is about to buy Annaly Capital (NYS: NLY) -- he hasn't specifically mentioned anything about it to me -- we can discover whether it's the sort of stock that might interest him. Answering that question could also inform whether it's a stock that should interest us.

In his most recent 10-K, Buffett lays out the qualities he looks for in an investment. In addition to adequate size and a reasonable valuation, he demands:

Consistent earnings power.

Good returns on equity with limited or no debt.

Management in place.

Simple, non-techno-mumbo-jumbo businesses.

Does Annaly meet Buffett's standards?

1. Earnings power

Buffett is famous for betting on a sure thing. For that reason, he likes to see companies with demonstrated earnings stability.

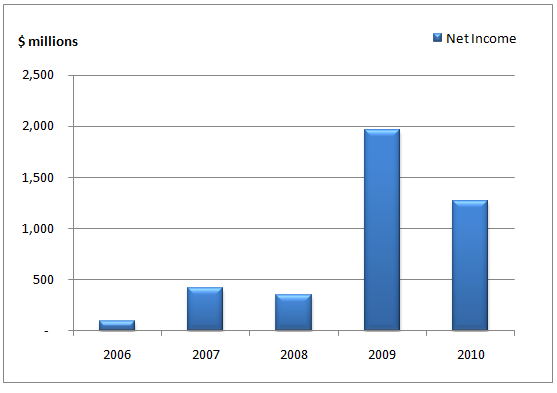

Let's examine Annaly's earnings history:

Source: Capital IQ, a division of Standard & Poor's.

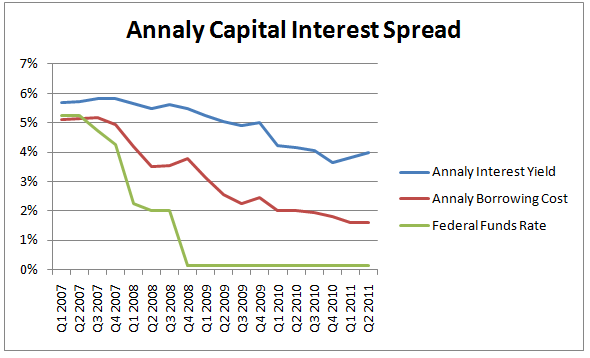

Annaly's earnings have grown fairly dramatically since the financial crisis. Here's why:

The interest rate spreads that dictate Annaly's profit margins have widened because of low short- term rates.

2. Return on equity and debt

Return on equity is a great metric for measuring both management's effectiveness and the strength of a company's competitive advantage or disadvantage -- a classic Buffett consideration. When considering return on equity, it's important to make sure a company doesn't have an enormous debt burden, because that will skew your calculations and make the company look much more efficient than it actually is.

Since competitive strength is a comparison between peers, and various industries have different levels of profitability and require different levels of debt, it helps to use an industry context.

Company | Debt-to-Equity | Return on Equity |

|---|---|---|

Annaly Capital | 5.8x | 17% |

American Capital Agency (NAS: AGNC) | 7.4x | 18% |

Chimera (NYS: CIM) | 1.9x | 18% |

Cypress Sharpridge (NYS: CYS) | 7.5x | 19% |

Source: Capital IQ, a division of Standard & Poor's.

Annaly doesn't seem to be generating the highest return on equity of its peers, though this may be partly because it appears to use leverage more sparingly. (Chimera makes up for its low leverage with a riskier portfolio.)

3. Management

Annaly's Chairman and CEO, Michael Farrell, has been at the job since he founded Annaly in 1997.

4. Business

This is a tricky one: Annaly's business doesn't involve technological uncertainty, though there is political risk should Fannie Mae and Freddie Mac be drastically reformed sometime down the road, and there is interest rate risk should the Fed decide to raise rates or members of Congress force the country to default.

The Foolish conclusion

Regardless of whether Buffett ever buys Annaly, we've learned that the company exhibits several characteristics of a quintessential Buffett investment: tenured management and a business that doesn't rely too heavily on technology innovation. Buffett might prefer to see a business with a stronger competitive advantage whose earnings are much less beholden to interest rates.

At the time thisarticle was published Ilan Moscovitzdoesn't own shares of any company mentioned.You can follow him on Twitter:@TMFDada. The Motley Fool owns shares of Chimera Investment and Annaly Capital Management. Try any of our Foolish newsletter servicesfree for 30 days. We Fools may not all hold the same opinions, but we all believe thatconsidering a diverse range of insightsmakes us better investors. The Motley Fool has adisclosure policy.

Copyright © 1995 - 2011 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.