Labor Peace, Dividend Yield, Widening Margins: Can You Hear Me Now?

In a deal about as conclusive as Congress' debt level agreement, Verizon Communications' (NYS: VZ) management and its unionized employees have agreed to disagree over cash and benefits terms for its 45,000 landline workers. The big weekend announcement included promises that two sides will offer up definitive contracts by ... well, some time in the future.

Investors celebrated this indecisive wrap-up by continuing a run-up in Verizon shares. In fact, investors seemed to have had no problem with Verizon's unhappy workers even during the time they were on strike. Since panic set into the market Aug. 8, which happens to be the same day the workers walked off, Verizon shares have gained more than 5%, despite general market unpleasantness, Verizon's market cap of roughly $100 billion undisturbed.

Verizon Communications Price Stock Chart by YCharts

What's up with Verizon that made it immune to share price dives during both a strike and a widespread market sell-off? And is it too late to join in? YCharts Pro finds these shares attractive on a dozen fronts, from Verizon's 5.50% dividend yield to its historically low price earnings valuation. But the charts can't see the inherent riskiness in Verizon's business model, which requires it to sell a whole lot of cell phone contracts to make up for the landlines customers are turning off.

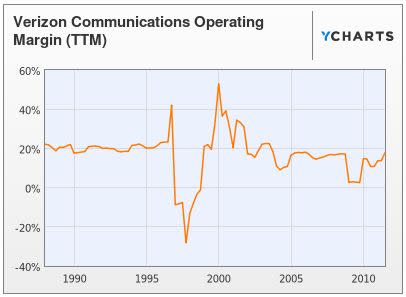

Actually, this old boy/adolescent mixture has worked pretty well lately. Landline services still make up more than half of Verizon's revenues (its FiOS broadband services are competitive), but that dominance within the company is falling. As it does, the company's profit margins improve because cell contracts are a lot cheaper to service than those real lines that go to individual customers.

Verizon Communications Operating Margin (TTM) Stock Chart by YCharts

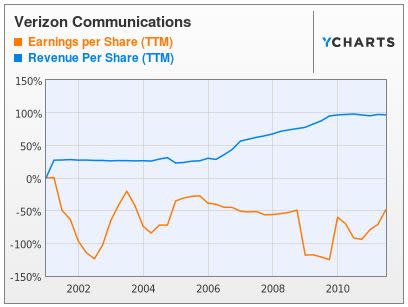

Even though Verizon has carved out a huge market share as a mobile carrier, those sales only barely cover the company's revenue losses on the landline side. But since revenues are just a vehicle to get profits, the dramatic earnings improvement with the changeover has been far more interesting.

Verizon Communications Earnings per Share (TTM) Stock Chart by YCharts

So, should we value Verizon like a growth company worth a premium share price, or more like one of those dying-industry companies forced to offer cheap shares and high dividends because their earnings alone will never offer much return? Before you say growth, keep in mind that Verizon Wireless' joint venture partner, Vodafone (NAS: VOD) , keeps a big chunk of the earnings from that side of the business.

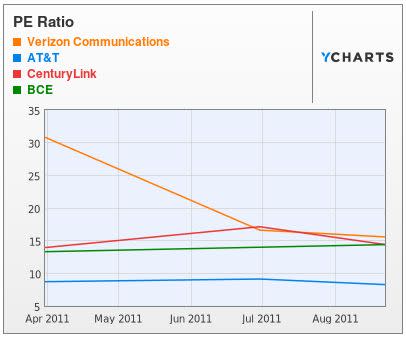

Right now, however, it's a moot point. Verizon's dividend yield is topping 5.5%. Its shares are about as cheap as they've ever been and competitively priced within the domestic telecom sector. They're on par with CenturyLink (NYS: CTL) , which doesn't have those big wireless revenues to help it grow. Verizon is more expensive than AT&T (NYS: T) , but it also has twice as much cash and a generally stronger balance sheet.

Verizon Communications P/E Ratio Stock Chart by YCharts

As the year rolls on, recession might slow down the number of mobile phone services Verizon can sell. But it also might spur more Verizon customers to ditch their landlines, and to this we can say, "good riddance." At least as investors. As unionized employees on the slow side of the business, we might want to negotiate for more shares.

Dee Gill is an editor for the YCharts Pro Investor Service which includes professional stock charts, stock ratings and portfolio strategies.

At the time thisarticle was published Motley Fool newsletter services have recommended buying shares of Vodafone Group and AT&T. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2011 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.