Before You Hang Up On CenturyLink: Consider Its Ridiculous Dividend Yield

Perhaps nothing says "buy me" in a trigger-happy market quite like an 8.7% dividend yield. A steady dividend payment at almost four times the 10-year T-bill rate really helps one take a more philosophical view of those nasty market sell-offs.

That makes giant telecom company CenturyLink (NYS: CTL) , with its, yes, 8.7% dividend yield, worth considering. But as YCharts has pointed out before, outsized dividends tend to come with outsized risks, as companies often boost the payouts to keep shareholders happy when profits can't. With a dividend of this size, something's probably wrong with the company.

Turns out CenturyLink, with a $20.69 billion market cap, has problems typical of companies that pay big dividends. But it also has revenue growth and a lot of cash that help mitigate investors' risk. YCharts gives it solid marks for fundamentals and value. Despite a recent cut in its earnings forecast, several analysts have recommended the shares recently.

One of CenturyLink's biggest problems lies in the trend toward ditching landlines in favor of cell phones, which cuts revenues from its key business of providing residential phone services. The company makes no bones about the magnitude of this problem, noting in its substantial risk factors section of regulatory filings that it is losing line-based business and probably won't get it back. The company's business model, which includes broadband Internet connection and satellite television, also pits it directly against cable companies. Nobody expects competition on any front to ease up any time soon.

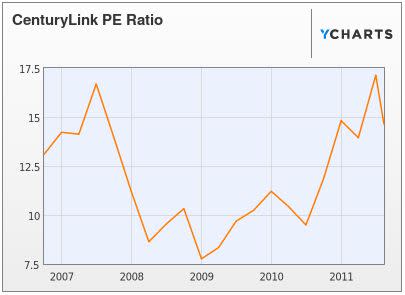

CenturyLink's share price has been falling since this depressing reality set in earlier this year, triggering a big jump in an already big dividend yield. The price decline also has made it one of the cheaper stocks in the domestic telecoms sector on a price/earnings valuation, although based on its own history, it's no particular bargain.

CenturyLink Price Stock Chart by YCharts

CenturyLink P/E Ratio Stock Chart by YCharts

For a tool to find other ridiculously high dividend stocks, click here. And for more coverage of dividend stocks, go here.

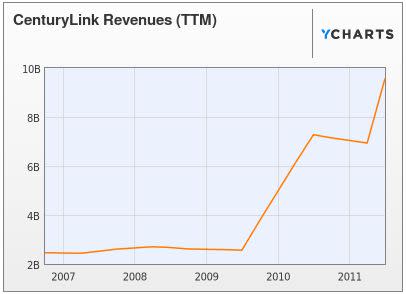

CenturyLink's increase in valuation recently comes from optimism over CenturyLink's plan to pull itself off this path of extinction through acquisitions. The spike in revenues below comes mainly from its $10.6 billion acquisition of Qwest Communications, a deal that made CenturyLink the third largest landline operator in the country. Unlike CenturyLink, which has a lot of rural residential customers, Qwest has a huge market share in corporate communications.

CenturyLink Revenues (TTM) Stock Chart by YCharts

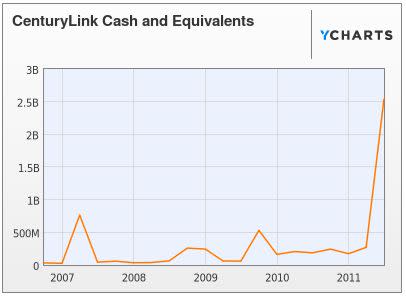

Other acquisitions are expected to get CenturyLink profits that are not linked to landlines. In April, for example, the company bought Savvis Communications and became a big player in data centers, those storage facilities for IT equipment. It also landed CenturyLink with much needed cloud computing services to offer customers. Because of some pretty high profit margins in the past, CenturyLink has cash to make these kinds of acquisitions.

CenturyLink Cash and Equivalents Stock Chart by YCharts

CenturyLink Free Cash Flow TTM Stock Chart by YCharts

This pile of money is particularly important for investors now, as it will have to pay the dividends while profits can't. Right now, dividends are eating through earnings.

CenturyLink Earnings per Share Stock Chart by YCharts

For long-term investors, the bet here is on the company's acquisition strategy. If these acquisitions don't pan out as planned -- if the company can't find enough of them, overpays, or simply goes into the wrong businesses -- the decline in share price will quickly shrink the total return to shareholders. Still, a dividend yield at this rate leaves a lot of room for mistakes.

Dee Gill is an editor for the YCharts Pro Investor Service which includes professional stock charts, stock ratings and portfolio strategies.

At the time thisarticle was published Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2011 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.