Selling Linn Energy? Here's What You Need to Know First

Should you sell Linn Energy (NAS: LINE) today?

The decision to sell a stock you've researched and followed for months or years is never easy. If you fall in love with your stock holdings, you risk becoming vulnerable to confirmation bias -- listening only to information that supports your theories, and rejecting any contradictions.

In 2004, longtime Fool Bill Mann called confirmation bias one of the most dangerous components of investing. This warning has helped my own personal investing throughout the Great Recession and the recent volatility throughout early August. In this series, I want to help you identify potential sell signs on popular stocks within our 4-million-strong Fool.com community.

Today I'm laser-focused on Linn Energy, ready to evaluate its price, valuation, margins, and liquidity. Let's get started!

Don't sell on price

Over the past 12 months, Linn Energy has risen 27.9% versus an S&P 500 return of 9.1%. Investors in Linn Energy have every reason to be proud of their returns, but is it time to take some off the top? Not necessarily. Short-term outperformance alone is not a sell sign. The market may be just beginning to realize the true, intrinsic value of Linn Energy. For historical context, let's compare Linn Energy's recent price to its 52-week and five-year highs. I've also included a few other businesses in the same or related industries:

Company | Recent Price | 52-Week High | 5-Year High |

|---|---|---|---|

Linn Energy | $37.86 | $41.13 | $41.10 |

Forest Oil (NYS: FST) | $19.92 | $40.23 | $83.10 |

EV Energy Partners LP (NAS: EVEP) | $66.21 | $73.37 | $73.40 |

EXCO Resources (NYS: XCO) | $14.54 | $21.04 | $40.90 |

Source: Capital IQ, a division of Standard & Poor's.

As you can see, Linn Energy is down from its 52-week high. If you bought near the peak, now's the time to think back to why you bought it in the first place. If your reasons still hold true, you shouldn't sell based on this information alone.

Potential sell signs

First, let's look at the gross margins trend, which represents the amount of profit a company makes for each $1 in sales, after deducting all costs directly related to that sale. A deteriorating gross margin over time can indicate that competition has forced the company to lower prices, that it can't control costs, or that its whole industry's facing tough times. Here is Linn Energy's gross margin over the past five years:

Source: Capital IQ, a division of Standard & Poor's.

Linn Energy is having no trouble maintaining its gross margin, which tends to dictate a company's overall profitability. This is solid news; however, Linn Energy investors need to keep an eye on this over the coming quarters. If margins begin to dip, you'll want to know why.

Next, let's explore what other investors think about Linn Energy. We love the contrarian view here at Fool.com, but we don't mind cheating off of our neighbors every once in a while. For this, we'll examine two metrics: Motley Fool CAPS ratings and short interest. The former tells us how Fool.com's 180,000-strong community of individual analysts rate the stock. The latter shows what proportion of investors are betting that the stock will fall. I'm including other peer companies once again for context.

Company | CAPS Rating (out of 5) | Short Interest (% of Float) |

|---|---|---|

Linn Energy | **** | 1.3 |

Forest Oil | *** | 6.0 |

EV Energy Partners LP | ***** | 1.0 |

EXCO Resources | *** | 8.1 |

Source: Capital IQ, a division of Standard & Poor's.

The Fool community is rather bullish on Linn Energy. We typically like to see our stocks rated at four or five stars. Anything below that is a less-than-bullish indicator. I highly recommend you visit Linn Energy's stock pitch page to see the verbatim reasons behind the ratings.

Here, short interest is at a mere 1.3%. This typically indicates few large institutional investors are betting against the stock.

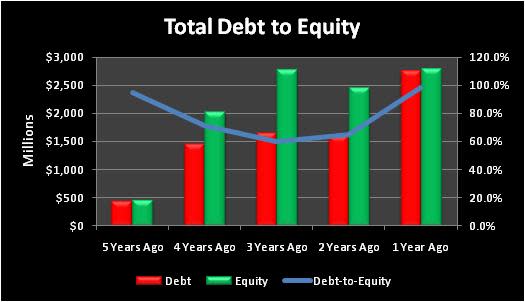

Now, let's study Linn Energy's debt situation, with a little help from the debt-to-equity ratio. This metric tells us how much debt the company's taken on, relative to its overall capital structure.

Source: Capital IQ, a division of Standard & Poor's.

Linn Energy has been taking on some additional debt over the past five years. When we take into account increasing total equity over the same time period, this has caused debt-to-equity to remain near its 5-year average, as seen in the above chart. I consider a debt-to-equity ratio below 50% to be healthy, though it varies by industry. Linn Energy is currently above this level, at 101.8%.

The last metric I like to look at is the current ratio, which lets investors judge a company's short-term liquidity. If Linn Energy had to convert its current assets to cash in one year, how many times over could the company cover its current liabilities? As of the last filing, Linn Energy has a current ratio of 1.40. Linn Energy could cover its current liabilities, but it's still below a healthy level of 1.5.

Finally, it's highly beneficial to determine whether Linn Energy belongs in your portfolio -- and to know how many similar businesses already occupy your stable of investments. If you haven't already, be sure to put your tickers into Fool.com's free portfolio tracker, My Watchlist. You can get started right away by clicking here to add Linn Energy.

The final recap

Linn Energy has failed only one of the quick tests that would make it a sell. This is great, but does it mean you should hold your Linn Energy shares? Not necessarily. Just keep your eye on these trends over the coming quarters.

In order to do that, I strongly recommend clicking here to add Linn Energy to My Watchlist to help you keep track of all of our ongoing coverage of the company.

At the time thisarticle was published Jeremy Phillipsdoes not own shares of the companies mentioned. Try any of our Foolish newsletter servicesfree for 30 days. We Fools may not all hold the same opinions, but we all believe thatconsidering a diverse range of insightsmakes us better investors. The Motley Fool has adisclosure policy.

Copyright © 1995 - 2011 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.