The Downgrade Be Damned: Here's What I'm Buying Now

On Friday, Standard & Poor's told us something we've all known for years: The U.S.' debt situation can no longer be ignored. The anticipation of this and other uncertainties has wickedly knocked the Dow down 1,200 points in the past two weeks, and it is showing no signs of stopping.

Today I'm telling you why none of that matters to enterprising long-term investors, and I'm letting you in on my personal plan to take extreme advantage of the situation. That's right -- I'm taking clear, specific actions with my own money this week, and I invite you to follow along.

Ignore the noise

As the market absorbs the story, you're likely to encounter dozens of so-called experts touting the "fall of America" and other nonsense, but they rarely put actions behind their breathless words. Unleashed from accountability, and taken in aggregate, they really are paralyzing, even to seasoned investors. This has always been the case, and will continue to be, but please join me in rising above this nonsense.

As an example, I recently came across this startling headline in the Boone County Republican:

A BANKRUPT NATION.

United States Almost a Mendicant in Money Centers.

Republicans have had no part in the great drama of national dishonor -- Democrats unable to fill their contract.

Sound familiar? I thought so, too. You and I have been hearing it our entire adult lives. I'm certain of this because this headline happens to be from the paper's Feb. 27, 1895edition. According to the "experts," America has spiraling downward each and every year for 116 years since that was printed. The criticism will continue in perpetuity, so it's really pointless for us to make rash moves as a result.

Now is the exact wrong time to panic. No one really knows where the market is going to close this week, but that genuinely does not matter. You shouldn't invest the cash you'll need in the next five years in the stock market, but everything else, with some variances based on your specific situation, should be considered fair game.

What feels right can be wrong

Your instincts (and many commentators) are going to tell you to hold off buying stocks until there's greater certainty or worse, to retreat to the safety of cash. I'll let you in on two facts that have also repeated themselves throughout history:

There will never be a time of complete certainty.

There's no safety in keeping your investable assets in cash.

Earning a mere 1% while your cash languishes will not only have you losing real spending power to inflation, but could also push your retirement back by as much as a decade -- if you get to retire at all. Where's the safety in that?

For a happy and secure retirement, you and I both are going to need the long-term, proven returns of the stock market. Despite how uncertain the world may seem, now is the perfect time to act. That's why I'm putting 10% of my investable cash in the stock below, no matter what happens this week.

And if the market continues to drop further, I'm making a commitment to you that I'll unleash another 50% of my investable cash. That's how confident I am in the long term, but more on that 50% in a minute.

Here's what I'm doing this week

I'm buying a worldwide company with an extraordinarily long history of rising above short-term turmoil, and rewarding shareholders with ever-increasing and reliable dividend payouts. This gives me outstanding geographic diversification, almost-guaranteed payouts through any short-term uncertainty, and money-market-thumping growth on my income.

Question: What's worse than an AA+ credit rating? Answer: The Great Depression

Back to 1895, when a certain newspaper called the United States "a bankrupt nation," another event quietly began occurring. In that year, Colgate-Palmolive (NYS: CL) began paying dividends on its common stock, and that has continued, 100% uninterrupted ever since. That's strong -- two world wars and a Great Depression strong, in fact. Add in that it has increased its (currently 2.8%) dividend in each of the past 48 years, and that its revenue sources are spread almost evenly around the world, and you have a great, diversified brand that I'm proud to own.

The safest place for your cash

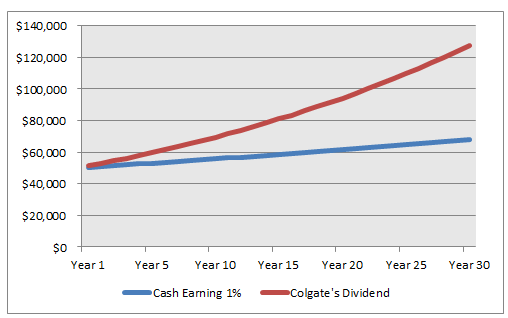

Back to "finding safety in cash," as the pundits call it. Here's what $50,000 looks like parked in cash versus what Colgate's dividend alone could return over the next 30 years, assuming it does roughly what it's done over the past 48 years.

Source: Author calculations.

And that's before any (extremely likely) share price appreciation over that time period. I really don't see the safety of cash in this scenario.

Outperforming expectations

Despite beating Wall Street analysts' expectations in its latest earnings report, Colgate's stock is slightly down with the market since. That's actually great news, as we can now buy the same company, and the same rock-solid dividend history, cheaper than we could before.

This story is actually being replicated throughout the broader market. Roughly 77% of the companies in the S&P 500 have beaten analyst estimates this earnings season, yet the market is down more than 1,200 points. That doesn't make a lot of sense, does it?

If Colgate isn't what you're looking for, here are four similar companies that recently beat analyst estimates, have impeccable dividend histories, and have declined over the past two weeks:

Company | Dividend Yield | Paid Uninterrupted Dividend Since | Price Change Over Past 2 Weeks |

|---|---|---|---|

United Technologies (NYS: UTX) | 2.6% | 1936 | (15.5%) |

IBM (NYS: IBM) | 1.7% | 1916 | (6.6%) |

Chubb (NYS: CB) | 2.6% | 1902 | (7.5%) |

VF Corp. (NYS: VFC) | 2.3% | 1986 | (7.6%) |

Source: Yahoo! Finance. As of Aug. 5.

60% of my investable cash on the line

As you can see, there are many great companies that have declined despite beating expectations, and I'm picking one of them, Colgate, for 10% of my investable cash. The Fool's trading restrictions require that I wait two days after this article is published to make my buy, but as soon as that's up, regardless of what happens with the market this week, I intend to load up on shares of Colgate. This is primarily to illustrate how little I care about what happens to the market this week, because I know just how small of an impact it has over the long term.

But I'm not stopping there. If at any point in 2011, the market falls another 15% from where it closed last Friday, I will invest another 50% of my investable cash in a handful of stocks, and of course, I'll write an article in this space before I do.

Worried about a further market drop?

If you think the market could drop another 15%, you can get a head start on my research right now. One of the stocks I'm seriously considering has similar attributes as the stocks above and is discussed in detail in The Motley Fool's most popular free report ever. It was named by one senior retail analyst as "the dividend play of a lifetime" and is joined in the report by 12 other outstanding dividend payers.

More than 300,000 investors have requested access to this special report, and today I invite you to download it at no cost to you. To get instant access to the names of these 13 high yielders, simply click here -- it's free.

At the time thisarticle was published Jeremy Phillipsowns no shares of the companies mentioned above ... yet. The Motley Fool owns shares of IBM. Try any of our Foolish newsletter servicesfree for 30 days. We Fools may not all hold the same opinions, but we all believe thatconsidering a diverse range of insightsmakes us better investors. The Motley Fool has adisclosure policy.

Copyright © 1995 - 2011 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.