Crisis Averted? The Latest on the Debt Ceiling

Nothing's sealed, but it looks like we've got a deal. The President and Congressional leaders have agreed on a package to raise the debt ceiling and reduce deficits by $2.5 trillion over the next decade. Congress still has to pass the package today (no sure thing, if you've been following this charade), but all signs point to the debt ceiling being raised, skirting a default on national debt that loomed as soon as tomorrow.

Here's how the deal works:

Immediately enacts federal spending cuts of about $1 trillion over a decade.

An immediate $900 billion increase in the debt ceiling (enough to last less than a year's worth of borrowing needs).

Tasks a bipartisan Congressional committee with finding an additional $1.5 trillion in deficit cuts by late November. The White House's term sheet says this will include "entitlement and tax reform." (Slides that House Speaker John Boehner presented to his caucus explicitly say tax increases are off the table, though that is disputed). If the committee is successful, the debt ceiling will be raised by another $1.5 trillion.

If the committee fails to find adequate savings, an automatic trigger will cut $1.2 trillion in additional spending over a decade, split between defense and non-defense spending, but sparing Social Security, Medicare, and what the White House calls "low-income programs." The debt ceiling would be raised by an additional $1.2 trillion.

A few things remained unknown.

The first is taxes. The president's outline notes that if the Congressional committee doesn't enact a balanced approach (spending cuts and tax hikes), an extension of the Bush tax cuts on upper-income earners is off the table. The tax cuts are set to expire in January 2013. Rather than being extended, "the President [could] use his veto pen to ensure nearly $1 trillion in additional deficit reduction by not extending the high-income tax cuts," says the White House.

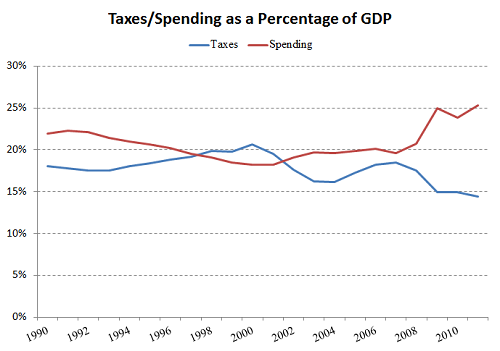

Regardless of how you feel about tax hikes (nobody likes them), the hard truth is that taxes have played a major role in current deficits. As a percentage of GDP, the drop in tax revenue has been nearly as severe as the increase in spending:

Source: Office of Budget and Management.

Taxes will come in at 14.4% of GDP this year, compared with a post-war average of 18%. Spending as a percentage of GDP will hit 25.3%, compared with a 20.3% long-term average. Much of a drop in tax revenue is a matter of high unemployment and a weak economy, but the same is true for the increase in spending: A quarter of the $1 trillion increase in annual federal spending since 2007 can be attributed to the higher cost of unemployment benefits and food stamps.

Also still unknown is where the spending cuts will fall. The agreement doesn't specify what exactly will be cut, but the makeup of federal spending suggests that large spending cuts can't be very broad. Almost 80% of federal spending is defense, entitlements, and unemployment benefits:

Total Federal Outlays (in billions)

Segment | 2011 | Percent of Total |

|---|---|---|

Defense | $768 | 20% |

Social Security | $748 | 20% |

Income Security* | $623 | 16% |

Medicare | $494 | 13% |

Health (Medicaid) | $388 | 10% |

Net Interest | $207 | 5% |

Veterans Benefits | $141 | 4% |

Education/Training | $115 | 3% |

Transportation | $95 | 2% |

Justice | $61 | 2% |

International Affairs | $55 | 1% |

Natural Resources/Environment | $49 | 1% |

Science/Space/Technology | $33 | 1% |

General Government | $32 | 1% |

Energy | $28 | 1% |

Community/Regional Development | $26 | 1% |

Agriculture | $25 | 1% |

Commerce and Housing | $17 | <1% |

Undistributed Offsetting Receipts | ($90) | (2%) |

Total | $3.8 trillion | 100% |

Source: Office of Management and Budget.

*Includes unemployment benefits, food stamps, etc.

The problem? All of those top programs are very popular, either among voters or lobbyists. The biggest battle of this debt debate might not have been during the past two weeks. It might come this fall, when the details of that agreement are being hammered out.

Also still on the table: a credit downgrade. The major rating agencies have America's credit rating on notice, warning that any deficit-reducing plan not up to par could lead to a downgrade. One S&P analyst specifically noted that avoiding a downgrade would mean cutting the deficit by $4 trillion over a decade. The current agreement doesn't do that. If the rating agencies stay true to their word, we could see a downgrade in the coming weeks or months.

We'll keep you updated as news rolls in. In the meantime, what do you think about the current deal? About how Washington has handled this mess? About the debt ceiling in general? Sound off in the comment section below.

At the time thisarticle was published Fool contributorMorgan Houseldoesn't own shares in any of the companies mentioned in this article. Follow him on Twitter @TMFHousel. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe thatconsidering a diverse range of insights makes us better investors. The Motley Fool has adisclosure policy.

Copyright © 1995 - 2011 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.