Caterpillar: Can China Change Its Fortune?

In today's world, most companies span several regions and sell across the globe. As Foolish colleague Morgan Housel notes, 10 years ago, less than a third of S&P 500 revenue came from overseas. Today, more than half of the S&P 500's growth comes from o verseas.

And that number is growing. The truth is, investors regularly underestimate how much demand comes from abroad. More importantly, for large, multinational corporations that have already established a presence in their home markets, much of their future growth comes from abroad.

With that in mind, today we're looking at Caterpillar (NYS: CAT) . We'll examine not only where its sales and earnings come from, but how its sales abroad have changed over time.

Where Caterpillar's sales were four years ago

Four years ago, Caterpillar relied heavily on the United States for revenue. Sales in North America accounted for 53% of total company sales.

Source: Capital IQ, a division of Standard & Poor's.

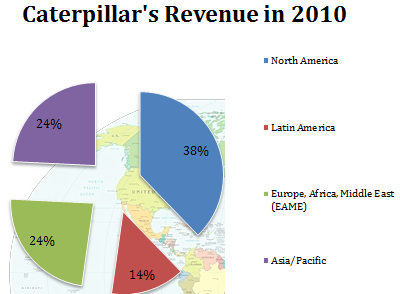

Where Caterpillar's sales are today

Today, Caterpillar's regional sales have changed drastically. Sales to the Americas have slid all the way down to 38% of total revenue, while Asia/Pacific rose from just 9% of sales in 2006 to become Caterpillar's second-largest market at 24% of sales.

Source: Capital IQ, a division of Standard & Poor's.

While there's much to be said about the structural problems facing the American heavy equipment market, the chart below is probably the best way of summarizing where opportunity awaits the company.

Region | 4-Year |

|---|---|

Company-wide total | 3% |

North America | (27%) |

Asia/Pacific | 169% |

Source: Capital IQ, a division of Standard & Poor's.

Competitor checkup

One last point to check is how Caterpillar's footprint compares to some of its peers across the broader machinery sector:

Company | Geography With Most Sales | Percent of Sales |

|---|---|---|

Caterpillar | North America | 38% |

Deere (NYS: DE) | United States and Canada | 65% |

Terex (NYS: TEX) | All Other* | 41% |

Source: Capital IQ, a division of Standard & Poor's.

*Includes all countries outside the United States and Europe. In terms of largest reported country, the United States accounts for 27% of sales.

Among its more direct peers, Caterpillar appears to have the most exposure to higher-growth Asian markets. In terms of geographic distribution, Terex is very similar, reporting 59% of sales to the U.S. and Europe. However, it uses a nebulous "all other" category that includes countries from Canada to China. This makes analyzing its overseas exposure difficult.

Interestingly, despite Caterpillar's dominance across the heavy equipment market, smaller competitors have managed to make inroads in the North American market where Caterpillar has seen precipitous declines. Specifically, Titan Machinery (NAS: TITN) -- which only reports sales in the United States -- saw its sales rise 274% during the same time Caterpillar saw North American sales swoon 27%.

For investors looking for growth in emerging-market infrastructure from markets other than China, another company with heavy international exposure is Capstone Turbine (NAS: CPST) . To be sure, it's a company with a heavy risk profile; its earnings have always been buried in red ink. However, the company produces a "green" product that competes with less efficient products like reciprocating engines from Caterpillar. What's interesting about Capstone Turbine is the company's geographic sales. Trailing shortly behind the United States is Russia, accounting for 25% of company sales.

If you look into Capstone and think its products can carve out a profitable niche, it comes with the added bonus of exposure to Russian infrastructure growth, which is difficult to find.

Keep searching

If you're looking to stay updated on Caterpillar, or any other company listed above, make sure to add them to our free watchlist service, My Watchlist. It's free, and it helps you stay updated on news and analysis on your favorite companies.

Add Caterpillar to My Watchlist.

Add Terex to My Watchlist.

Add Deere to My Watchlist.

Add Titan Machinery to My Watchlist.

Add Capstone Turbine to My Watchlist.

At the time thisarticle was published Eric Bleekerowns no shares of any companies listed above. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe thatconsidering a diverse range of insightsmakes us better investors. The Motley Fool has adisclosure policy.

Copyright © 1995 - 2011 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.