15 Famous CEOs Who Ended Up Behind Bars

Monopoly Jail

The story of Elizabeth Holmes, the blood-test entrepreneur whose product never worked, captivated court-watchers for years. She was sentenced to prison in 2022 and now will not be released until December 2032. But Holmes is hardly alone in going from executive offices to a prison yard. While some CEOs work quietly and behind the scenes, others love the limelight and fame that comes with representing a company, and white-collar crime — from fraud to insider trading — has taken many a chief executive from fame to infamy. Here are some of the most notable who ended up behind bars for their crimes. They’re led by Holmes but otherwise ranked by the size of their sentences and identified by the year of their sentencing.

Elizabeth Holmes (2022)

Criminal charge: Fraud and conspiracy to commit wire fraud

Sentence: 11 years and three months in prison, reduced to just over 9 years

Theranos was founded in 2003 on the power of Elizabeth Holmes — a college dropout who idolized Steve Jobs — to fundraise on the dream of diagnosing medical problems from just a drop of blood. But $140 million in investor money couldn’t make the technology work, and funds came in based on her assurances it did. In January 2022, a jury decided those were lies, not wishful thinking, but it took a week for a verdict to come down.

Martha Stewart (2004)

Criminal charge: Obstruction of justice, lying to federal investigators

Sentence: Five months in prison, two years of probation

Served: Five months

Martha Stewart became the most stylish inmate of Federal Prison Camp Alderson in West Virginia for perjury as part of the ImClone insider trading scandal. When ImClone’s experimental infusion drug for cancer patients was denied approval by the Food and Drug Administration in 2001, Stewart’s broker, Peter Bacanovic, tipped her off, prompting Stewart to sell her shares before the news broke.

Joseph Nacchio (2007)

Criminal charge: Inflating revenue estimates, insider trading, lying about nonexistent forthcoming government contracts, and profiting illegally from a run-up in stock price

Sentence: Six years and $19 million in fines

Served: Five years, six months

After Qwest Communications International CEO Joseph Nacchio and a group of execs were indicted by the Securities and Exchange Commission on charges of fraud and lying about government contracts, his lawyers had a next-level defense: They said Nacchio believed he would get government contracts to help Qwest get in the black, but the offers stopped when he refused to join a National Security Agency surveillance program in February 2001. As part of his sentence, Nacchio was to forfeit $52 million earned through illegal trading.

Richard Scrushy (2007)

Criminal charge: Extortion, money laundering, obstruction of justice, racketeering, and bribery

Sentence: Six years and 10 months

Served: Five years

Former HealthSouth CEO Richard Scrushy had a laundry list of charges against him describing nearly two decades of illegal and illicit practices such as bribing and threatening execs, firing whistleblowers, and illegal accounting practices. Scrushy was originally indicted in 2003, but acquitted in 2005. Next time, not so lucky.

Martin Shkreli (2017)

Criminal charge: Securities fraud and conspiracy

Sentence: Seven years

Served: Five years

Martin Shkreli, AKA the “Pharma Bro,” rose to notoriety when he increased the price of Daraprim, which treats a potentially fatal parasitic infection, to $750 a pill from less than $15. He was convicted for lying to investors about the success of the funds and using company funds to cover personal debts, but an unrelated lawsuit demands that he return $65 million. And the judge in that case decreed that when he’s freed from a federal correctional institution in Allenwood, Pennsylvania, he’s banned from the pharmaceutical industry for the rest of his life. He's currently free and living in New York City.

Samuel D. Waksal (2003)

Criminal charge: Securities fraud, bank fraud, obstruction of justice, and perjury

Sentence: Seven years and 3 months

Served: Five years

The founder of ImClone Systems and Kadmon Pharmaceuticals, Waksal led the development of the cancer drug Erbitux, the drug that failed FDA approval and embroiled Martha Stewart in her scandal.

Martin L. Grass (2004)

Criminal charge: Conspiracy to defraud, false statements, and accounting fraud

Sentence: Eight years and a $500,000 fine

Served: Five, followed by a year in a halfway house

Martin L. Grass held the position of Rite-Aid CEO for just four years before he was indicted with several other company execs for covering up $1.6 billion in fraudulent accounting. He nearly ruined the company started by his father — the scandal erased almost 90% of shareholder value.

Dennis Kozlowski (2005)

Criminal charge: Securities fraud

Sentence: Eight to 25 years

Served: Six and a half years

Dennis Kozlowski was accused of draining nearly $600 million from Tyco — funds he used to pay for his lavish tastes, blowing money on opulent parties, ice sculptures, artwork, and even spending upward of $15,000 on dog umbrella stands. He was convicted after claiming the bonuses he got were given the green light by the board of directors.

Sanjay Kumar (2006)

Criminal charge: Securities fraud conspiracy and obstruction of justice

Sentence: 12 years in prison

Served: Five years

Sanjay Kumar led a multibillion-dollar fraud as the CEO of Computer Associates by falsifying financial statements at the software company. Kumar and his team spent years adding extra weeks of work to the books and backdating contracts. Kumar was able to avoid prosecution for more than five years before being eventually indicted.

Walter Forbes (2007)

Criminal charge: Fraud

Sentence: 12 years and seven months, and $3 billion in damages

Served: 11 years and six months

When Hospitality Franchise Systems merged with Comp-U-Card International to form Cendant in 1998, it was quickly discovered that Walter Forbes — who led Comp-U-Card and became leader of Cendant — lied about Comp-U-Card’s financial status, having reported nonexistent profits totaling more than $500 million.

John Rigas (2002)

Criminal charge: Bank, wire, and securities fraud

Sentence: 15 years in federal prison

Served: One year

The former CEO of the cable television company Adelphia Communications, John Rigas, was indicted with sons Michael and Timothy and four other executives after hiding billions in owed loans and using corporate money for personal expenses. He was granted compassionate release in 2016 after just a year in prison because of a terminal bladder cancer diagnosis. He lived five more years before dying at 96 in 2021.

Jeffrey Skilling (2006)

Criminal charge: Conspiracy, securities fraud, and making false statements to auditors

Sentence: 24 years and four months

Served: 12 years

An instrumental piece of the Enron scandal, Skilling was part of the overvaluing of Enron’s holdings, even going as far as changing losses on contracts to look like gains. Most notably, Skilling signed off on Enron’s subsidiary, Chewco — which was used to hide the debts Enron was hiding. Skilling was convicted in May 2006 and served the longest sentence of any Enron defendant. Today he is working at a startup firm.

Bernard Ebbers (2005)

Criminal charge: Conspiracy, securities fraud, and false reports to regulators

Sentence: 25 years in prison

Served: 13 years

As the CEO of WorldCom, Bernie Ebbers’ crimes came to light when a merger with Sprint fell through in 2000, causing the company's stock to crash and Ebbers to cook the books in an effort to cover billions in losses. Internal auditors discovered an $11 billion fraud. Ebbers was given early release from his sentence in 2019 because of his health issues. He died shortly thereafter, in February 2020.

R. Allen Stanford (2012)

Criminal charge: Fraud

Sentence: 110 years

Once one of the wealthiest people in the country, Allen Stanford was convicted on 13 of 14 charges of selling $7 billion in fraudulent certificates of deposit — considered the second-biggest Ponzi scheme in history. Stanford’s scheme was an international scandal, as he was a dual citizen of the United States and Antigua and Barbuda, and had branches of his bank on the island and in Venezuela. He was sentenced by a Houston federal judge and stripped of his knighthood in Antigua after his crimes left the nation financially ailing; he was the largest employer on the island. Stanford maintains his innocence.

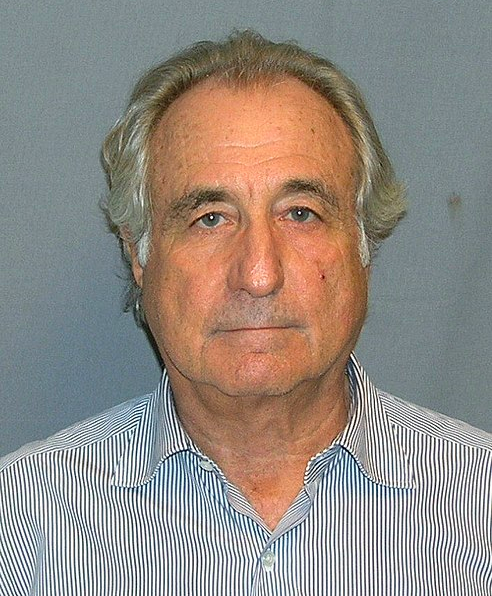

Bernard Madoff (2008)

Criminal charge: Securities fraud, wire fraud, mail fraud, perjury, and money laundering

Sentence: 150 years in prison

Bernie Madoff was an American financier and is known for running the largest Ponzi scheme in history — worth nearly $65 billion. Madoff’s scheme ran for decades; it wasn’t until the stock market collapse of 2008 that his schemes caught up to him. He confessed to his sons, who turned him in. Madoff, still in prison, died in April, 2021, at age 82.

This article was originally published on Cheapism