The Dirty Dozen: 12 Signs The Car Dealership Is Ripping You Off

Don't Get Taken for a Ride

Plenty of car dealers are honest and operate with integrity. Others see a big fat bullseye on your back the second you enter. Dealers negotiate vehicle deals every single day, but you've done it once or twice — or maybe never. Face it, they're probably better at negotiating than you because they do it all the time. But if you know what to watch out for, you can avoid the most common pitfalls when buying a car.

The Disappearing Financing Act

After driving home in your new vehicle, you get a call or letter from the dealer informing you that your on-the-spot financing application has been rejected, and you now have to apply for another loan at a higher rate. This is considered the "disappearing financing" act, and you can avoid this trap by securing outside financing before shopping.

Rushing You Into a Deal

When dealers sense hesitation, they'll sometimes try to force buyers off the fence by telling them that the deal they offered is good only for that day, or that another buyer is interested in the same car. This is their attempt to force you into an emotion-based decision. If you're not absolutely sure, be prepared to walk away and sleep on it. Even with shortages brought on by pandemic supply-chain issues, there are always more cars and other dealers.

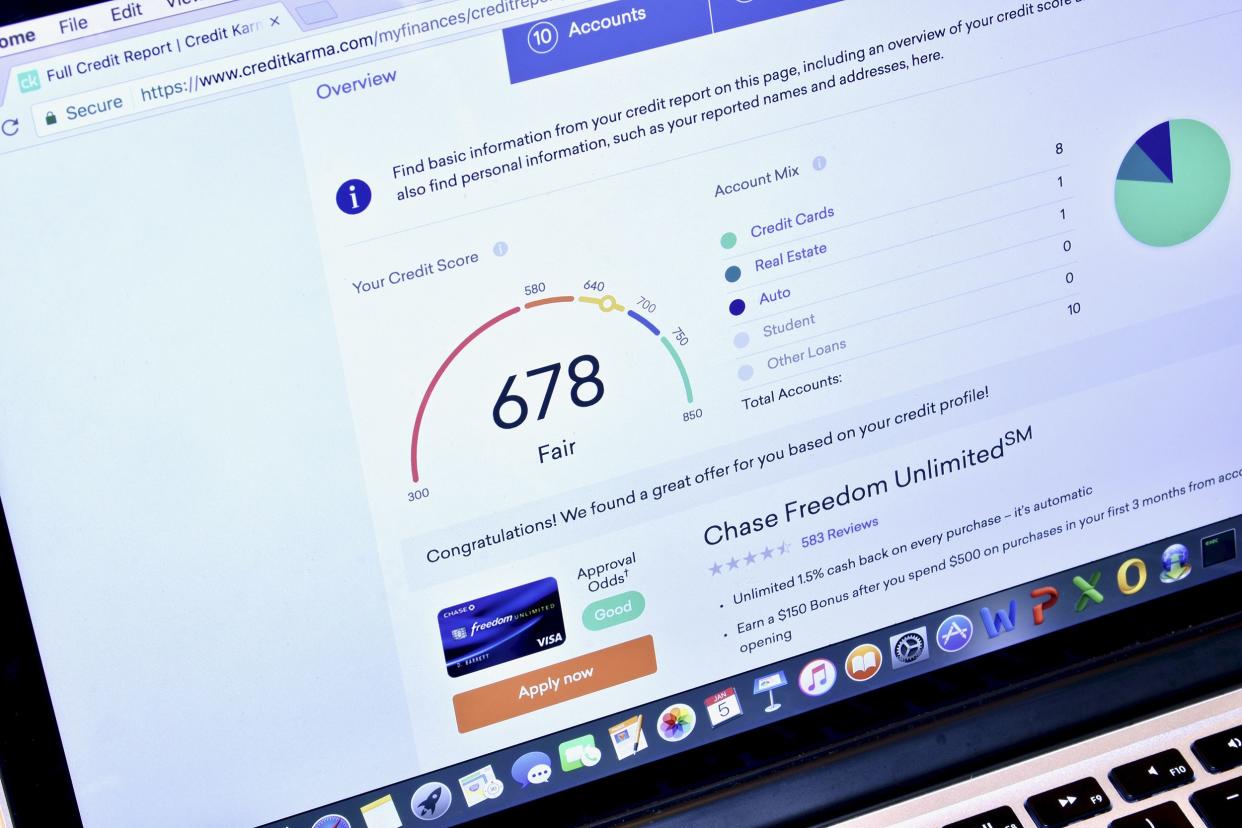

The Low Credit Score Scam

It's no secret that borrowers with excellent credit get the lowest rates on the best loans. What many people don't know is that unscrupulous dealers sometimes tell car buyers that their all-important credit score came back lower than it actually is. This means paying a higher interest rate and missing out on lucrative dealer incentives. The solution is to check your credit score with all three bureaus before shopping so you know your bargaining power.

Related: How You're Destroying Your Credit Score Without Knowing It

Making You Pay For Dealer Prep

"Dealer prep" is a fee commonly tagged onto itemized bills that unsuspecting buyers are prone to giving just a glance. Often $500 or $600, the fee supposedly compensates dealers for extra labor they put into securing your vehicle. In reality, it's a hidden add-on. Beat this scam by examining the purchase receipt and inquiring about every single charge before signing. Negotiate to have the fee reduced or removed entirely.

Promising to Pay Off Your Trade-in Loan — And Failing To

If you can, pay off an existing loan before you trade in a car. If you must trade in a car that you owe money on, the balance of the first loan will be added to the loan on the car you're buying, because the dealer is supposed to pay off whatever is owed on the trade-in. Sometimes, however, they simply keep the extra money. In the end, the bank loaned you the money for the vehicle and it's you — not the shady dealer — who is responsible for paying it.

For more smart auto stories, please sign up for our free newsletters.

Avoiding Discussion of Monthly Payments

When dealers ask about a buyer's budget, they often do so in terms of monthly payments. Don't take the bait. When you quote a number, the dealer will find a way to work within your budget — often by extending the term of the loan. You could pay nearly $10,000 more over the term of a seven-year loan than you would for a five-year loan, even though the monthly payment was $400 for the same car in both cases.

Doing a Bait-and-Switch With Advertised Deals

Television is packed with car commercials promising juicy deals with 0% financing for a certain number of months. Those commercials come with blocks of tiny, fast-moving print explaining that the deal applies only to buyers with excellent credit who have huge down payments. When most customers get to the dealership, they often find that the same car comes with a far less attractive deal for them.

Saddling You With Interest and Taxes on Rebates

Rebates are often used as incentives to buy — but they come from the manufacturer and are applied no matter what price you pay. When negotiating, do so as if the rebates don't exist. When it's time to convert the rebates into cash, ask to have them applied to the price of the car. If the dealer mails you a check, you'll have to pay interest and taxes.

Selling Useless Add-ons

Dealers make big bucks by convincing unsuspecting buyers that extras are actually necessities. Called "add-ons," these upcharges are often completely unnecessary — and almost always expensive. Say no to rustproofing, extended warranties, fabric protection, and VIN etching.

Related: Car Products That Are a Complete Waste of Money

Keeping Your Hold Deposit

Sometimes dealers will tell buyers who are on the fence that they can hold the car for them as long as the prospective buyer leaves a deposit, which can be hundreds or thousands of dollars. In many cases, this happens before loan terms are agreed upon. If the buyer decides not to buy or doesn't like the terms, shady dealers will sometimes refuse to refund the deposit. The moral of the story? Never leave a hold deposit.

Roping Buyers Into a Lease

In some cases, when a buyer balks at the terms of the loan, the dealer will offer to lower the monthly payments with no money down if the purchase happens right away. The trick is that the dealer switched to a lease agreement from an outright purchase — sometimes without the buyer's knowledge.

Negotiating From the MSRP

When you use the Manufacturer's Suggested Retail Price as a starting point for negotiations, you're vulnerable to dealers who will try to wow you by knocking off, say, $1,000. The problem is, the MSRP is artificially high. Ask about the dealer invoice — the price the dealer paid for the car. Then try to stay as close to that number as possible.

Related: Questions to Ask Before Buying a Used Car