12 Most Affordable States for the Middle Class

The middle class has been slowly shrinking, as income inequality grows, wages stagnate and inflation skyrockets. However, there are still states in the U.S. where a middle-class income -- generally speaking -- can go decently far.

Student Loan Forgiveness: Mark These 4 Dates on Your Calendar Now

Related: States Whose Economies Are Failing vs. States Whose Economies Are Thriving

To determine these states, GOBankingRates applied the OECD's definition of "middle class" as making 75% to 200% of a geographical area's median income. We then determined middle class income ranges for each state sourced from the Census Bureau's Current Population Survey.

GOBankingRates also found average monthly mortgage payments from Zillow's Home Value Index to a 30-year fixed mortgage, and further utilized data from LendEDU, which analyzed aggregated anonymized data from 150,000 Truebill users, to determine average student loan payments; U.S. News & World Report's breakdown of car ownership by geography to determine monthly car payments; and Experian's 12th Annual State of Credit Report of total average credit card debt by state to determine monthly credit card payments.

GOBankingRates then found the annual income for each state to be considered middle class by calculating debt payments as a maximum 36% of income, the upper threshold recommended by financial advisors. Here are the 12 most affordable states for the middle class.

12. Missouri

Annual income needed to be "middle class": $75,294.00

Mortgage needed for average home: $1,537.00

Monthly car costs: $461.50

In Missouri, while the middle class begins at just over $75,000, the average state income falls short by over $27K, at $47,695.50.

11. Louisiana

Annual income needed to be "middle class": $73,389.56

Mortgage needed for average home: $1,435.00

Monthly car costs: $520.67

Louisianans also have an average monthly student loan cost of $192.62 and a monthly credit card payment of $53.40

10. Indiana

Annual income needed to be "middle class": $72,439.56

Mortgage needed for average home: $1,478.00

Monthly car costs: $447.42

In Indiana you need over $72,000 per year to be middle class, but the median annual income (on the low end) is almost $20,000 less than that at $52,642.50.

Take Our Poll: Are You Struggling To Keep Up With Your Utility Bills?

9. Kansas

Annual income needed to be "middle class": $71,318.56

Mortgage needed for average home: $1,384.00

Monthly car costs: $501.67

In Kansas, the middle class is making a car payment that's almost one/third their mortgage, as well as a $200.54 monthly student loan payment and a $53.35 monthly credit card payment.

8. Alabama

Annual income needed to be "middle class": $70,849.22

Mortgage needed for average home: $1,400.00

Monthly car costs: $469.67

While you need to earn almost $71,000 per year to qualify as middle class, the high end of median earners make more than $113,858.00 per year in Alabama.

7. Ohio

Annual income needed to be "middle class": $69,147.89

Mortgage needed for average home: $1,415.00

Monthly car costs: $407.67

In Ohio, you may need to earn nearly $70,000 per year to qualify as middle class, but median earners on the low end are only earning about $47,000 per year. Median earners on the high end can easily afford their bills, however, as they are earning over $125,000 per year.

6. Kentucky

Annual income needed to be "middle class": $68,247.22

Mortgage needed for average home: $1,308.00

Monthly car costs: $492.67

Kentucky residents in the middle class are better positioned to afford their bills, including a monthly student loan payment of almost $200, and a monthly credit card payment of nearly $50.

5. Iowa

Annual income needed to be "middle class": $66,219.78

Mortgage needed for average home: $1,282.00

Monthly car costs: $453.58

In Iowa the median earner (on the low end) isn't far from qualifying as middle class, at $54,321.75 per year.

4. Oklahoma

Annual income needed to be "middle class": $64,845.44

Mortgage needed for average home: $1,221.00

Monthly car costs: $474.83

In Oklahoma, middle class earners can also expect to pay a monthly student loan payment of $195.25 and a monthly credit card payment of $54.28.

3. Arkansas

Annual income needed to be "middle class": $63,014.78

Mortgage needed for average home: $1,199.00

Monthly car costs: $440.83

In Arkansas, while the low-end median earner is only making $38,088.00, which is almost $24,000 less than the amount to qualify as middle class, the high-end median earner is averaging $101,568.00 per year.

2. Mississippi

Annual income needed to be "middle class": $62,294.33

Mortgage needed for average home: $1,117.00

Monthly car costs: $506.25

In Mississippi, the gap between middle class and median earner is a gap of over $27,000. Still middle-class earners are paying additional bills, such as a monthly student loan cost of $198.17 and a monthly credit card bill of $47.41.

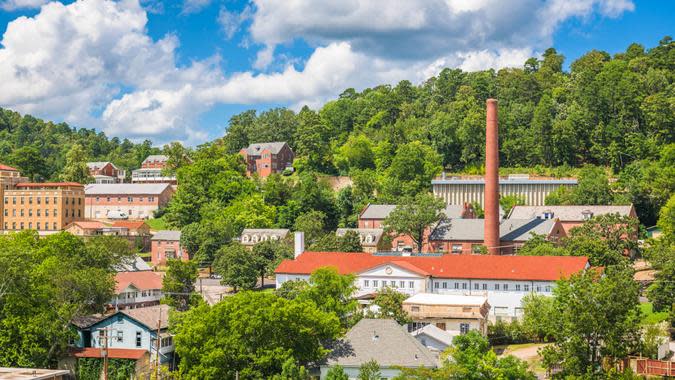

1. West Virginia

Annual income needed to be "middle class": $54,011.22

Mortgage needed for average home: $929.00

Monthly car costs: $443.42

In West Virginia, you don't even have to make it much past $54,000 to be considered middle class. And mortgage and car costs here are a bit lower than the rest of the states on this list, but monthly student loan costs are about as high as the rest of the states, at $199.48, and a monthly credit card payment of $48.44.

Other states that are also more affordable for the middle class, rounding out spots 13 through 25, include the following:

Nebraska

Michigan

Wisconsin

Pennsylvania

Illinois

North Dakota

South Dakota

New Mexico

South Carolina

Tennessee

Georgia

Alaska

Minnesota

More From GOBankingRates

Methodology: For this study, GOBankingRates applied (1) the OECD's definition of "middle class" as making 75% to 200% of a geographical area's median income. GOBankingRates then determined middle class income range for each state by (2) analyzing median wage data sourced from the Census Bureau's Current Population Survey and multiplied the incomes by 0.75 for lowest threshold and by 2 for upper threshold. GOBankingRates found (3) average monthly mortgage payments by applying typical home prices by state, sourced from Zillow's Home Value Index to a 30-year fixed mortgage at a 6.97% interest rate (not accounting for individual variables such as down payment, taxes, PMI, and insurance). GOBankingRates further utilized data from (4) LendEDU, which analyzed aggregated anonymized data from 150,000 Truebill users, to determine average student loan payments; (5) U.S. News & World Report's breakdown of car ownership by geography to determine monthly car payments; and (6) Experian data on total average credit card debt by state, multiplied by 1% (the minimum monthly payment required by most major credit cards) to determine monthly credit card payments. GOBankingRates then found the annual income for each state to be considered middle class by calculating debt payments as a maximum 36% of income, the upper threshold recommended by financial advisors. Data is accurate as of October 10, 2022.

This article originally appeared on GOBankingRates.com: 12 Most Affordable States for the Middle Class