I Make $100,000 a Year. How Much House Can I Afford?

On a salary of $100,000 per year, as long as you have minimal debt, you can afford a house priced at around $311,000 with a monthly payment of $2,333. This number assumes a 6.5% interest rate and a down payment of around $30,000.

The 28/36 rule is often used as a guide when deciding how much house you can afford. The rule stipulates that you should not spend more than 28 percent of your salary on overall housing costs and no more than 36 percent on housing costs and your debt. On a salary of $100K with debts of about $250 per month, a house costing $311,000 just fits in your budget.

However, how much home you can afford depends on other factors also, such as where you intend to live and how much you have saved as a down payment.

This article looks at how all of these factors affect your home purchase and gives some examples of how much home you can realistically afford on a salary of $100,000.

What Kind of House Can I Afford With $100K a Year?

Another rule of thumb often applied when buying a home is to not spend more than three times your annual income on a home. If you earn $100,000 a year, that would be $300,000.

A salary of $100,000 is well above the national median income (according to Census data, the national median income was $74,580 in 2022). That puts you in a good position if you want to buy a home, particularly if the cost of living is low in the area that you are targeting. If you have substantial savings for a down payment and little debt, you’re even better positioned. Debt is important because lenders look at how much debt you have when they qualify you for a mortgage.

Your Debt-to-Income Ratio

Your debt-to-income (DTI) ratio is the amount of income you receive relative to the amount of payments you make each month to cover your debt. You’ll get better loan terms, and your monthly mortgage loan payments will be less, if you have less debt.

That’s why many experts also recommend the 28/36 rule. So, if you earn $100K, your housing costs should be less than $28,000, $2,333 a month, and your debt and housing costs should not exceed $36,000, or $3,000 a month.

Your Down Payment

Unless you qualify for a zero-down USDA or VA loan, most lenders will expect a down payment of between 3% and 20%. The more you put down, the more house you can afford, but as you think about your down payment amount, make sure you reserve funds for closing costs, moving costs, and an emergency fund for unexpected expenses.

Home Affordability

Homes are more affordable in certain areas. Some areas have a higher cost of living and higher property taxes.

Your credit score will also affect how much home you can afford. If you have a high credit score, you will qualify for a lower interest rate loan. If you pay less interest, you can borrow more and still meet your monthly payments.

Depending on where you want to live, the housing market might dictate how big a home you can afford. House prices are affected by the economic conditions, and low unemployment rates and healthy economic growth gives buyers more purchasing power. If buyers have more purchasing power, they can afford bigger loans, and this will push up house prices.

How to Afford More House with Down Payment Assistance

Some people, such as first-time buyers or certain professionals like nurses and teachers, can qualify for down payment assistance from federal, state, and local government, private entities, and charitable organizations. Assistance might be in the form of a low-rate loan, cash grant, tax credit, or a reduced interest rate.

Applying for down payment assistance can add weeks or months to your home buying timeline, but for more information, the U.S. Department of Housing and Urban Development (HUD) keeps a list of programs listed by state, county, and city.

Here are typical down payment amounts for various types of mortgages.

Conventional mortgages require a 3% down payment for first-time buyers

FHA mortgages require 3.5% down

VA mortgages require 0% down

USDA: These zero down payment loans serve low-income borrowers in rural areas.

Home Affordability Examples

Let’s take a look at some hypothetical examples for those wondering, “If I make $100K how much home can I afford?” These examples assume an interest rate of 6.5% and average property taxes.

Example #1: Low Down Payment and Significant Debt

Gross annual income: $100,000

Down payment: $10,000

Monthly debt: $1000

Home budget: $238,441

Monthly mortgage payment: $2,000

Payment breakdown:

Principal and interest: $1,444

Property taxes: $208

Private mortgage insurance: $264

Homeowner’s insurance: $83

Example #2: Bigger Down Payment, Less Debt

Gross annual income: $100,000

Down payment: $40,000

Monthly debt: $300

Home budget: $333,212

Monthly mortgage payment: $2,333

Payment breakdown:

Principal and interest: $1,853

Property taxes: $208

Private mortgage insurance: $188

Homeowner’s insurance: $83

How to Calculate How Much House You Can Afford

You need a budget to find out how much house you can afford. Keeping a budget will show you how much you are spending each month versus how much income you have. Whatever you have leftover after paying essentials like food, clothing, and utilities is how much you can afford to spend on housing.

You can also use a mortgage calculator to help you. Just plug in your own numbers to find out what your monthly payments would be.

How Your Monthly Payment Affects Your Price Range

The more you can afford to pay each month for your mortgage and other housing expenses, the more house you can afford. However if you have significant debt payments each month, or you have a poor credit score that results in a higher interest rate for your loan, that will reduce the amount of loan you can afford and the price range.

Types of Home Loans Available to $100K Households

Four types of loans are the most common. These are conventional loans, FHA loans, USDA, and VA loans.

Conventional loans typically require a credit score of 620 or more, but the down payment can be as low as 3 percent. Remember that a lower down payment means higher monthly payments because you will have to borrow more.

FHA loans. With an FHA loan, home buyers with a credit score over 580 can borrow up to 96.5% of a home’s value. Home buyers with a lower credit score, between 500 to 579, can still qualify for a loan as long as they have a 10% down payment.

USDA: USDA loans are zero down payment financing for low-income borrowers in designated rural areas.

VA: VA loans also require no down payment and are available to qualified military service members, veterans, and their spouses.

The Takeaway

If you are looking to buy a home and would like a more realistic idea of what you can afford, first find out how much you are spending on necessities like food, clothing, transportation, and, most importantly, debt. What you have leftover is how much you can spend each month on housing expenses.

Once you have a grasp on your finances, you can use an affordability calculator to see how much of a house you can afford. The size of home that the amount will buy depends on the local housing market and the cost of living where you want to live.

This article originally appeared on SoFi.com and was syndicated by MediaFeed.org.

SoFi Loan Products

SoFi loans are originated by SoFi Bank, N.A., NMLS #696891 Opens A New Window.(Member FDIC). For additional product-specific legal and licensing information, see SoFi.com/legal. Equal Housing Lender.

SoFi Mortgages

Terms, conditions, and state restrictions apply. Not all products are available in all states. See SoFi.com/eligibility for more information.

*SoFi requires Private Mortgage Insurance (PMI) for conforming home loans with a loan-to-value (LTV) ratio greater than 80%. As little as 3% down payments are for qualifying first-time homebuyers only. 5% minimum applies to other borrowers. Other loan types may require different fees or insurance (e.g., VA funding fee, FHA Mortgage Insurance Premiums, etc.). Loan requirements may vary depending on your down payment amount, and minimum down payment varies by loan type.

Financial Tips & Strategies: The tips provided on this website are of a general nature and do not take into account your specific objectives, financial situation, and needs. You should always consider their appropriateness given your own circumstances.

Third-Party Brand Mentions: No brands, products, or companies mentioned are affiliated with SoFi, nor do they endorse or sponsor this article. Third-party trademarks referenced herein are property of their respective owners.

External Websites: The information and analysis provided through hyperlinks to third-party websites, while believed to be accurate, cannot be guaranteed by SoFi. Links are provided for informational purposes and should not be viewed as an endorsement.

+Lock and Look program: Terms and conditions apply. Applies to conventional purchase loans only. Rate will lock for 91 calendar days at the time of preapproval. An executed purchase contract is required within 60 days of your initial rate lock. If current market pricing improves by 0.25 percentage points or more from the original locked rate, you may request your loan officer to review your loan application to determine if you qualify for a one-time float down. SoFi reserves the right to change or terminate this offer at any time with or without notice to you.

Tax Information: This article provides general background information only and is not intended to serve as legal or tax advice or as a substitute for legal counsel. You should consult your own attorney and/or tax advisor if you have a question requiring legal or tax advice.

¹FHA loans are subject to unique terms and conditions established by FHA and SoFi. Ask your SoFi loan officer for details about eligibility, documentation, and other requirements. FHA loans require an Upfront Mortgage Insurance Premium (UFMIP), which may be financed or paid at closing, in addition to monthly Mortgage Insurance Premiums (MIP). Maximum loan amounts vary by county. The minimum FHA mortgage down payment is 3.5% for those who qualify financially for a primary purchase. SoFi is not affiliated with any government agency.

†Veterans, Service members, and members of the National Guard or Reserve may be eligible for a loan guaranteed by the U.S. Department of Veterans Affairs. VA loans are subject to unique terms and conditions established by VA and SoFi. Ask your SoFi loan officer for details about eligibility, documentation, and other requirements. VA loans typically require a one-time funding fee except as may be exempted by VA guidelines. The fee may be financed or paid at closing. The amount of the fee depends on the type of loan, the total amount of the loan, and, depending on loan type, prior use of VA eligibility and down payment amount. The VA funding fee is typically non-refundable. SoFi is not affiliated with any government agency.

More from MediaFeed:

Do You Make More Than the Average Person in Your State?

Whether you’re deciding on a new career path or wondering if you’re being paid enough, it can help to know what the typical American worker earns per year.

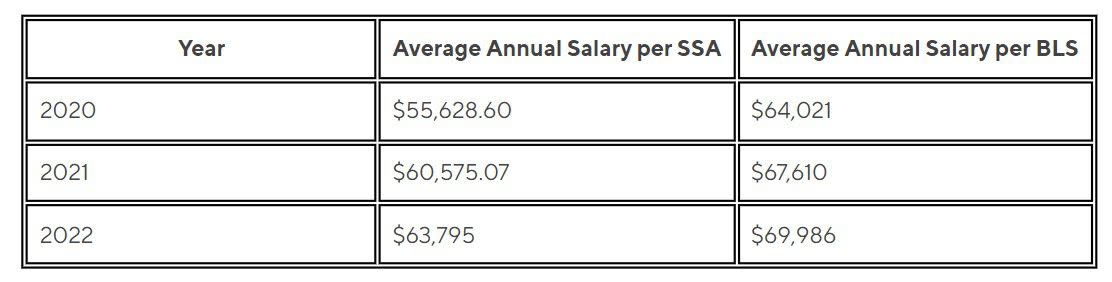

Based on the latest data available from the Social Security Administration (SSA), the average annual pay in the U.S. in 2022 was $63,795 — a 5.32% jump from the previous year. The U.S. Bureau of Labor Statistics (BLS) estimates the average worker made closer to $69,986 that same year. The amount you make may depend on a number of factors, including your occupation, where you live, your gender, and your level of education.

AndreyPopov / iStock

Let’s take a closer look at how the average annual pay in the U.S. has changed over a three-year period based on data from both the SSA and BLS.

Sofi

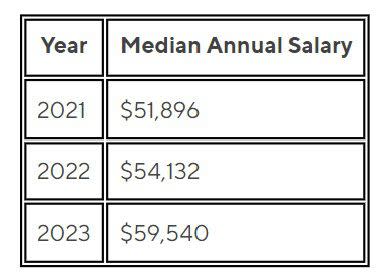

It can also be helpful to look at median earnings, which represent the midpoint of salaries in the U.S. In other words, half of the salaries fall below the median, and half are higher than the median.

As you can see, average and median incomes have risen each year. However, average salaries can be affected by various factors such as your occupation, age, and gender. Note that the numbers above also don’t include unearned income.

The following table shows the median annual salary for a three-year period.

Sofi

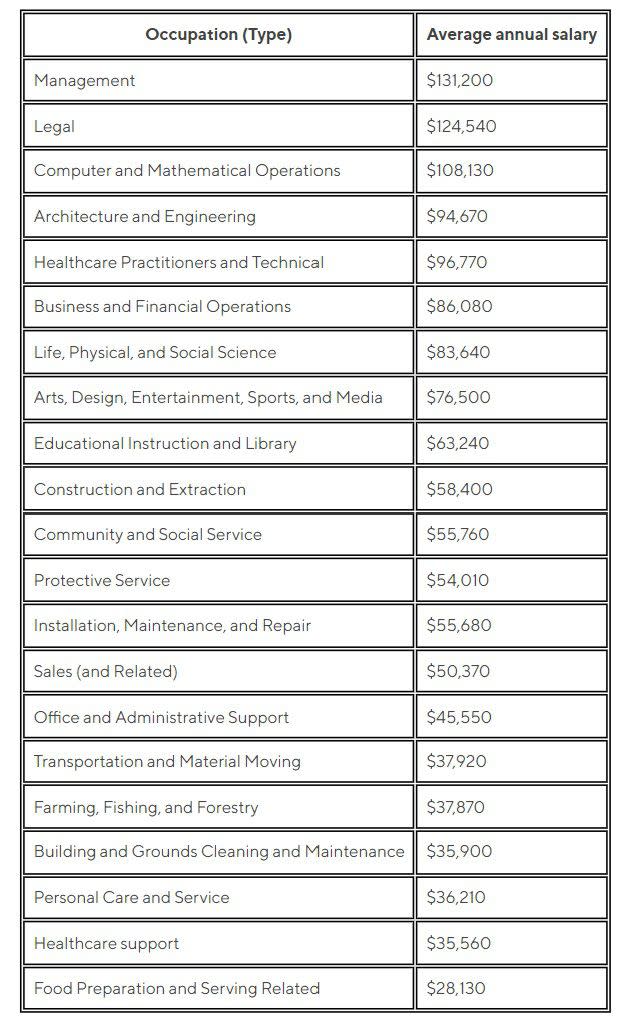

Some industries tend to pay more than others, which means the career you choose may affect how much you earn. Here’s a sampling of high-paying jobs and their average annual salary, according to the BLS:

- Cardiologist, $421,330

- Dentist, $172,290

- Aircraft pilots and flight engineer, $225,740

- Lawyer and judicial law clerk, $161,680

- Public relations manager, $150,030

- Air traffic controller, $130,840

While salaries tend to vary based on geography, seeing how much certain types of jobs pay can be informative. Let’s take a look at different occupations and how much they typically pay.

Keep in mind that average salaries may differ depending on the specific occupation you have. For example, although claims adjusters fall under the business and financial operations category, their average salary is around $72,040.

Demographics, specifically gender, are another factor to consider. By and large, men tend to outearn women throughout their career. The median annual salary for a 16- to 24-year-old man is $38,688; a woman of the same age earns $36,088, per the latest data available from the BLS. Likewise, the median annual salary for a man aged 25 and older is $64,376; a woman of the same age earns $52,520.

Jacob Wackerhausen/istockphoto

Wages often vary based on where you live. In many cases, states with higher costs of living also have higher wages. For example, the median annual income in Hawaii is $104,704 — much higher than Mississippi’s median annual income of $70,950.

Next is the median income by state for a household of three people, according to data compiled by the Census Bureau between April 1 and May 14, 2023.

coffeekai/istockphoto

Median annual income: $77,419

Cavan Images/istockphoto

Median annual income: $113,035

Milepost430Media/istockphoto

Median annual income: $90,193

Sean Pavone / istockphoto

Median annual income: $74,475

Brandon Olafsson/istockphoto

Median annual income: $104,785

choness/istockphoto

Median annual income: $113,822

Jonathan Ross/istockphoto

Median annual income: $121,958

SeanPavonePhoto/istockphoto

Median annual income: $103,598

Bo Shen/istockphoto

Median annual income: $146,440

LUNAMARINA/istockphoto

Median annual income: $83,396

ULora/istockphoto

Median annual income: $87,742

Kruck20/istockphoto

Median annual income: $104,704

todamo/istockphoto

Median annual income: $87,960

knowlesgallery/istockphoto

Median annual income: $101,951

Dawid S Swierczek/istockphoto

Median annual income: $89,800

Aaron Yoder/istockphoto

Median annual income: $95,739

Wirestock/istockphoto

Median annual income: $88,271

Median annual income: $75,700

hstiver / istockphoto

Median annual income: $73,393

Sean Pavone/istockphoto

Median annual income: $95,531

Sean Pavone/istockphoto

Median annual income: $122,385

Tim Pruss/istockphoto

Median annual income: $127,172

Sean Pavone/istockphoto

Median annual income: $93,873

JerryB7/istockphoto

Median annual income: $114,267

atosan/istockphoto

Median annual income: $70,950

SeanPavonePhoto/istockphoto

Median annual income: $89,515

Sean Pavone/istockphoto

Median annual income: $84,019

Jacob Boomsma/istockphoto

Median annual income: $99,845

Wirestock/istockphoto

Median annual income: $86,618

miroslav_1/istockphoto

Median annual income: $136,886

Ultima_Gaina/istockphoto

Median annual income: $122,540

ChrisBoswell / istockphoto

Median annual income: $71,283

Sean Pavone/istockphoto

Median annual income: $103,444

bloodua/istockphoto

Median annual income: $87,369

Wirestock/istockphoto

Median annual income: $93,240

Jacob Boomsma/istockphoto

Median annual income: $90,912

Sean Pavone/istockphoto

Median annual income: $77,166

Sean Pavone/istockphoto

Median annual income: $101,989

ChrisBoswell / istockphoto

Median annual income: $100,888

Kyle Little/Istockphoto

Median annual income: $109,514

Sanghwan Kim/istockphoto

Median annual income: $82,114

SeanPavonePhoto / istockphoto

Median annual income: $92,794

kayeway605/ iStock

Median annual income: $85,014

Ultima_Gaina/istockphoto

Median annual income: $87,228

istockphoto/f11photo

Median annual income: $102,941

legacyimagesphotography/istockphoto

Median annual income: $103,763

SeanPavonePhoto/istockphoto

Median annual income: $111,017

SeanPavonePhoto/istockphoto

Median annual income: $116,345

aiisha5/istockphoto

Median annual income: $81,964

Sean Pavone/istockphoto

Median annual income: $99,261

marchello74/istockphoto

Median annual income: $93,651

robertcicchetti/istockphoto

As the BLS data below shows, there is often a pay disparity among workers of different races and ethnicities.

- Asian, $79,456 per year

- White, $60,164

- Black or African American, $50,284

- Hispanic or Latino, $45,968

Now that you’ve seen some of the average and median annual salaries by occupation, location, gender, and race or ethnicity, how does yours compare? If you’re not making as much as you’d like, you may want to research wages in your industry and region, and use that information to help you negotiate a higher salary. If you’re ready to make a bigger change, you can use this data as you consider whether to switch to a more lucrative field or relocate to a higher-paying region.

KucherAV/istockphoto

Here are some different strategies to help you make the most of the money you make:

Track Your Spending

Understanding exactly where your money is going can help you keep tabs on where your money is going and identify areas where you can cut back. Consider using a spending app to track your spending and saving.

Negotiate Bills

Want to lower monthly expenses, such as your cell phone or internet services? Consider calling up various providers to see if you’re able to get a better deal or if there are promotions you can take advantage of.

Cut Back on Large Expenses

Housing, food, and transportation tend to be the largest line budget items. Explore ways to trim your biggest costs. Examples include refinancing your mortgage, negotiating your rent, shopping at discount grocery stores, and taking public transportation when possible.

Sharpen Your Marketable Skills

Accepting networking opportunities and taking professional development courses could help you become more marketable as an employee. This in turn could set you up to earn more in the long run. If you’re on a tight budget, look into no- or low-cost ways to cultivate high-income skills, and ask your employer if there are any free resources available.

Ridofranz/istockphoto

A high income can be great, but it does come with some downsides.

Pros:

- Improved quality of life: With more money, you can afford a higher standard of living and be able to afford different amenities such as better access to healthcare and food.

- Financial security: The more you earn, the more you can feel secure you have enough money to afford the things you want and need.

- Ability to achieve financial goals faster: Having more disposable income could mean you can set more money aside for long- and short-term savings goals, like retirement or going on a family vacation.

Cons:

- Higher taxes: Earning more can put you in a higher tax bracket. However, there are ways to reduce your taxable income.

- Pressure to maintain income: If you’re accustomed to a certain living standard, you may feel like you need to keep earning the same amount or more to maintain it.

- More work stress: In many cases, higher-paying jobs come with more responsibilities and, at times, longer hours.

Understanding what the average American worker makes in a year can come in handy, especially if you’re considering a new career path, negotiating a higher salary, or looking for a new place to live. According to the latest data from the Social Security Administration, the average annual pay in the U.S. is $63,795. But the amount you earn may depend on a wide range of factors, such as the industry you work in, where you live, your gender, and your race or ethnicity.

This article originally appeared on SoFi.com and was syndicated by MediaFeed.org.

SoFi Relay offers users the ability to connect both SoFi accounts and external accounts using Plaid, Inc.’s service. When you use the service to connect an account, you authorize SoFi to obtain account information from any external accounts as set forth in SoFi’s Terms of Use. Based on your consent SoFi will also automatically provide some financial data received from the credit bureau for your visibility, without the need of you connecting additional accounts. SoFi assumes no responsibility for the timeliness, accuracy, deletion, non-delivery or failure to store any user data, loss of user data, communications, or personalization settings. You shall confirm the accuracy of Plaid data through sources independent of SoFi. The credit score is a VantageScore® based on TransUnion® (the “Processing Agent”) data.

Third-Party Brand Mentions: No brands, products, or companies mentioned are affiliated with SoFi, nor do they endorse or sponsor this article. Third-party trademarks referenced herein are property of their respective owners.

Non affiliation: SoFi isn’t affiliated with any of the companies highlighted in this article.

Tax Information: This article provides general background information only and is not intended to serve as legal or tax advice or as a substitute for legal counsel. You should consult your own attorney and/or tax advisor if you have a question requiring legal or tax advice.

Financial Tips & Strategies: The tips provided on this website are of a general nature and do not take into account your specific objectives, financial situation, and needs. You should always consider their appropriateness given your own circumstances.