1 Cryptocurrency Stock Up 30% in 2024 That Could Keep Soaring

I have been very critical of Robinhood Markets (NASDAQ: HOOD) during the last couple of years, which wasn't necessarily controversial given that its stock suffered a peak-to-trough collapse of 91% from its all-time high. The online brokerage platform was consistently losing active users, and its transaction revenue seemed to be in perpetual decline as a result.

However, Robinhood's fortunes have changed in 2024. A rising stock market has brought users back into the fold, and they are actively transacting, which is driving the company's revenue higher.

The fastest-growing part of Robinhood's business right now, though, is the cryptocurrency segment, where revenue more than tripled year over year during the recent first quarter of 2024 (ended March 31). Robinhood stock has soared 30% in 2024 so far, but here's why it could be poised to go higher.

Robinhood's most important metric has turned higher

Robinhood's monthly active users (MAU) peaked at 21.3 million during the second quarter of 2021. It declined in almost every quarter since then, bottoming at 10.3 million near the end of 2023. It was the primary reason I was bearish on the company's prospects. Simply put, generating sustainable revenue growth will be extremely difficult if the number of users to monetize continues to shrink.

However, Robinhood's MAU has turned higher since that low point, and the metric currently stands at 13.7 million. The company also had a record-high 23.9 million in total funded customer accounts at the end of the first quarter, and the value of the assets held within them soared 65% year over year to $130 billion.

The latter figure was helped by rising stock and cryptocurrency prices. The major U.S. stock market indexes each hit a record high in 2024, and so has leading cryptocurrency Bitcoin.

Robinhood's customers also deposited $11.2 billion in new funds during the quarter. The platform earns fees through a practice called payment for order flow, which involves forwarding customer orders to third-party market makers for fulfillment. Sending a $10,000 stock or cryptocurrency order earns Robinhood a higher fee compared to a $5,000 order, so its assets under custody is a very important indicator of its potential to earn revenue.

Robinhood's revenue soared during Q1

Robinhood generated a record $618 million in revenue during Q1, 40% more than the year-ago period. But the real story is beneath the surface of the headline number.

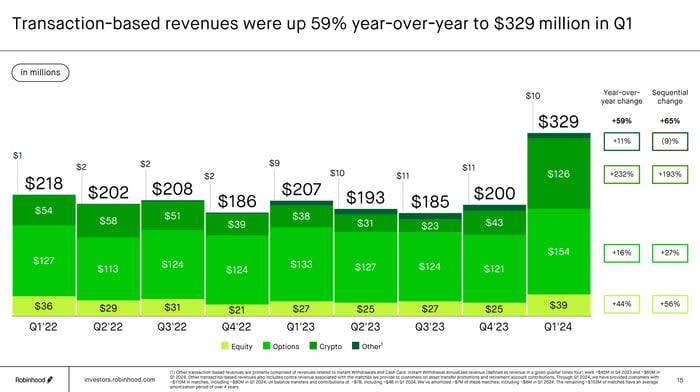

Transaction revenue jumped 59% to $329 million, which is important because this is earned through the company's brokerage operations. There was a positive contribution from all asset classes (equity, options, and crypto), but crypto was the standout performer, with revenue soaring by 232%:

Image source: Robinhood Markets.

This was a welcome change from 2023, when Robinhood's total revenue was mostly driven higher by interest income instead. The company has $4.7 billion in cash and equivalents on its balance sheet, plus it's holding $4.5 billion on behalf of customers, so the rapid rise in interest rates during the past couple of years increased the amount it was earning by storing that money in banks.

Robinhood also earns interest on its credit card product and its margin lending activities. Overall, the company generated $254 million in total interest revenue during Q1, which was a 22% increase year over year. That number could shrink in the coming year if the U.S. Federal Reserve cuts interest rates as expected, which makes the resurgence in Robinhood's transaction revenue even more important.

Finally, Robinhood continues to build on its progress on the bottom line. The company's operating costs fell 52% during Q1, and since revenue grew so quickly, that led to $157 million in GAAP (generally accepted accounting principles) net income -- a huge swing from the $511 million net loss from the year-ago period.

Most of the decline in operating costs was attributable to the cancellation of Robinhood's founders award, which granted stock to the company's founding team. That led to a $536 million reduction in stock-based compensation expense during Q1.

Why Robinhood stock could head higher from here

To Robinhood's credit, it wasn't deterred by its crumbling stock price post-2021. The company continued to innovate and expand its product portfolio, and those initiatives are starting to bear fruit.

For example, it introduced a retirement offering in January 2023, and it already has more than 650,000 customers on board. During Q1, Robinhood's assets under custody for the retirement segment topped $4 billion, which was a 14-fold increase from its launch a year earlier. Many of Robinhood's customers are young, first-time investors, so it could yield a powerful long-term revenue stream if it can convince them to stick around for their decades-long journey to retirement.

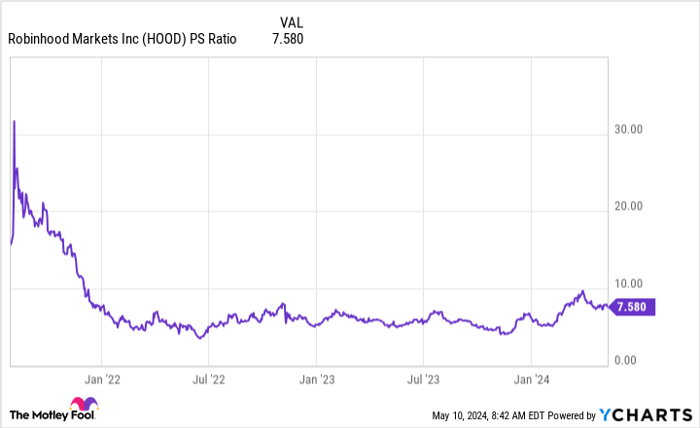

Robinhood is currently valued at almost $15 billion. Based on its trailing 12-month revenue of $2 billion, its stock trades at a price to sales (P/S) ratio of about 7.6. That's down substantially from its peak, which was set during 2021, because the company's revenue has grown along with its decline in stock price:

HOOD PS Ratio data by YCharts

I have previously made the argument that Robinhood's shrinking user base and stagnant revenue warranted a low P/S ratio. However, now that the top line has returned to growth -- led by a significant acceleration in transaction revenue -- it makes sense for the stock's P/S ratio to tick higher.

Therefore, there could be more upside ahead for Robinhood investors.

Should you invest $1,000 in Robinhood Markets right now?

Before you buy stock in Robinhood Markets, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Robinhood Markets wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $550,688!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of May 6, 2024

Anthony Di Pizio has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Bitcoin. The Motley Fool has a disclosure policy.