These Were the 2013 Holiday Season's 'Not' Sellers

The 2013 Christmas season was more ho-hum than bah humbug. The Commerce Department reported on Tuesday that sales at U.S. retailers rose a mere 0.2 percent in December, though that balloons up to 0.7 percent if we back out the auto industry.

That's not great. But it was even worse for those companies whose products were flat-out disappointments. Let's go over four things that did not sell well during the holiday shopping season.

Yoga Pants

One of the retailing world's biggest winners in recent years has been Lululemon Athletica (LULU). The Canadian chain of high-end active-wear for affluent customers has a presence in the ritziest shopping malls.

Well, it seems as if customers are finally starting to flinch at paying $100 for a pair of yoga pants. Lululemon announced on Monday that sales for the holiday quarter will clock in between $513 million to $518 million, well short of its earlier forecast of $535 million to $540 million. Instead of the flat comparable-store sales that Lululemon was originally projecting it experienced negative comps.

It's fair to say that Lululemon has had a challenging year. There was the embarrassing springtime recall of its Luon stretch pants because they were too sheer, and then its longtime CEO stepped down.

The stock chart is starting to look -- in yoga vernacular -- like a downward facing dog.

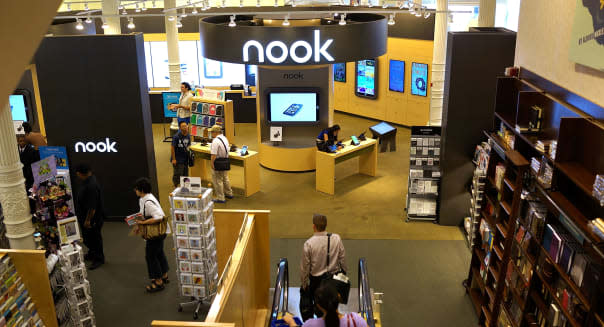

Nooks

Barnes & Noble's (BKS) dream of being a major force in e-readers has turned into a nightmare. The company reported that Nook sales plunged during the nine-week holiday season.

%VIRTUAL-article-sponsoredlinks%It was pretty bad. The actual hardware sales declined 66.7 percent as customers avoided buying new Nooks and accessories. Barnes & Noble didn't put out a new tablet last year, so a decline was inevitable. However, it's hard to bounce back after Nook sales have plummeted by two thirds.

Digital content sales fell by a more modest 27.3 percent -- also terrible news since there are more Nooks out there now than there were a year ago. They're just collecting more dust than before, and that's bad news for the bookseller's once-promising digital ecosystem.

Consumer Electronics

We live in what should be an exciting time for consumer electronics, but things haven't been going according to plan. Pricier items -- things like TVs and PCs -- have been slumping for a couple of years, and now even the smaller gadgetry is starting to suffer.

When it comes to consumer electronics, hhgregg (HGG) isn't the largest player in the niche, but it did send the shares of all of its peers lower last week after offering up an ugly holiday report. It may have experienced gains in appliances and home products, but comps for its consumer electronics fell 19.7 percent.

It gets worse. Computing and wireless products tumbled 24.5 percent for the pivotal holiday shopping period. We may not be as plugged in as you may think.

'Sleep Number' Beds

Mattresses have been quiet winners in the housing market's recovery. After all, if you're going to buy a new home, you're going to need somewhere to sleep. Folks moving out will often toss their old, lumpy mattresses.

Select Comfort (SCSS) is a leader in the high-end bedding market. Its Sleep Number beds offer air-chambered mattresses with adjustable firmness settings. Unfortunately for its shareholders, Select Comfort has warned that holiday sales didn't live up to earlier expectations. It was originally forecasting for quarterly sales at its company-controlled stores to post comps in the mid-single digits. Things may have started out that way, but weakness since Cyber Monday finds Select Comfort now holding out for flat store-level sales.

Motley Fool contributor Rick Munarriz has no position in any stocks mentioned. The Motley Fool recommends Lululemon Athletica. The Motley Fool owns shares of Barnes & Noble. Try any of our newsletter services free for 30 days.