58 percent of millennials still prefer to get paid with cash

Whether people are splitting a lunch check or going in on a group gift, they have more payment choices today than just cash or check. Digital options like peer-to-peer ― also called person-to-person ― (P2P) payment apps and electronic bank transfers are other ways to pay and receive payments from friends or family.

When it comes to new money technologies, millennials ages 18 to 34 are the most likely to adopt and rely on digital payment tools, according to a 2015 Accenture Payment Services survey, and over half of millennials use digital channels to transfer money, according to a 2015 white paper from First Data.

Millennials also might find themselves in the position to weigh payment methods more often, as this age group is the most open to borrowing and lending money. A study from social network lending platform Vouch found that 84 percent of millennials say they would lend money to family and friends.

But while digital payment apps like Venmo or Square Cash are gaining the most traction among millennials, they haven't entirely replaced traditional payment methods ― not by a long shot. To track how millennials handle money between family and friends, GOBankingRates conducted a Google Consumer Survey to ask what their preferred method to pay and get paid is.

Survey Findings: Millennials' Preferred Methods for P2P Payments

GOBankingRates' survey collected 1,000 responses from people ages 18 to 34, the age group that falls within the millennial generation. The survey asked, "Of the following, which is your preferred way of paying and getting paid back by friends and family?" One answer selection was allowed of the following options, displayed randomly:

Cash

Check

Electronic bank transfer

Google Wallet

PayPal

Square Cash

Venmo

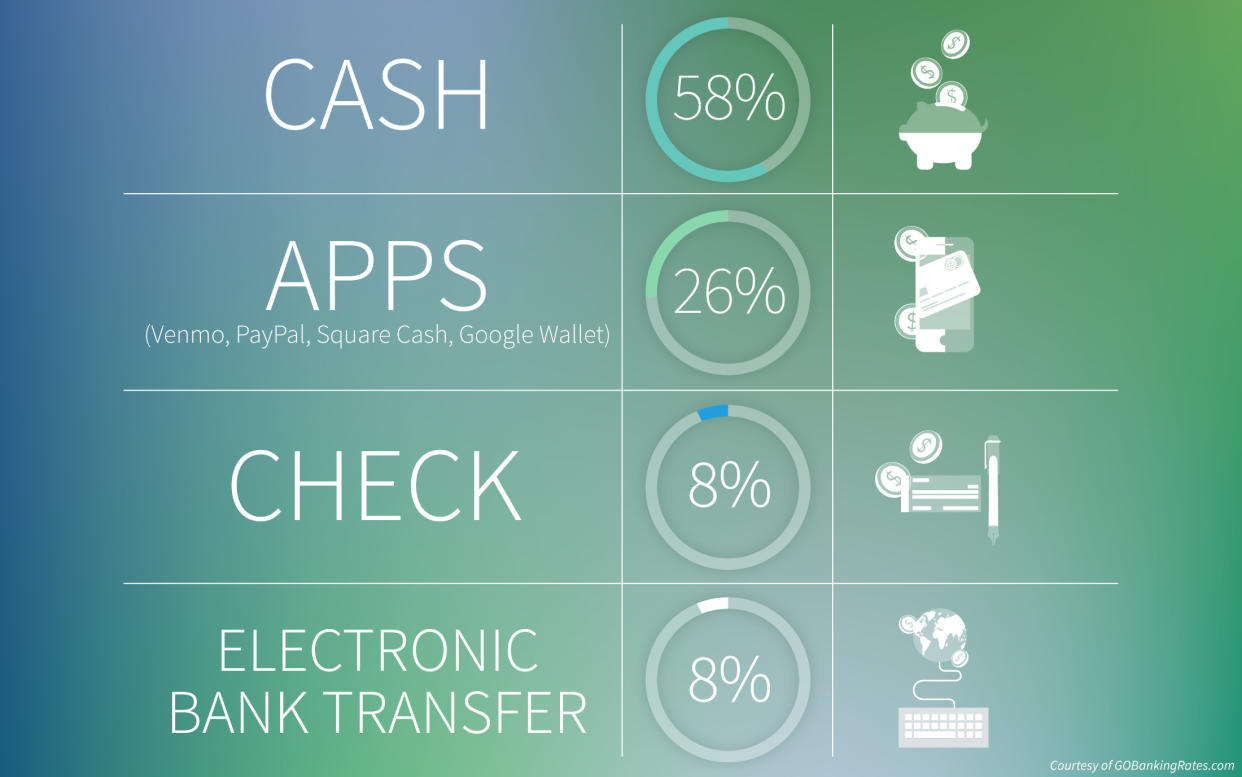

Even for the Digital Generation, Cash Is Still King

Cash is king even among millennials, with most (58 percent) of respondents saying this is their preferred P2P payment method. This result parallels an overall preference for cash among millennials. A 2014 study on consumer spending habits by the Federal Reserve System found that young millennials (ages 18 to 24) are the most likely to prefer paying with cash, at 40 percent, and 2016 survey from Cardtronics found that about half (45 percent) of millennials said they are actually more likely to pay with cash now than they were a few years ago.

When it comes to exchanging money with friends or family, cash is a classic option. Exchanging it is as easy as opening a wallet, and there are no service fees or processing times to pay friends compared with some digital services. "Even as our economy becomes increasingly cashless, cash is still great because it's instantaneous and nobody takes a transaction fee," said David Weliver, founder of Money Under 30, a personal finance site for young adults.

1 in 4 Millennials Prefers P2P Payment Apps Like PayPal and Venmo

P2P payment apps are the second-most popular payment method among millennials. One in four respondents (26 percent) chose one of the payment apps listed as an answer option -- Google Wallet, PayPal, Square Cash or Venmo -- as their favorite way to pay friends or get paid back. The 26 percent breaks down as follows:

PayPal -- 11 percent

Venmo -- 6 percent

Google Wallet -- 5.1 percent

Square Cash -- 4.3 percent

PayPal is the clear favorite of the P2P payment options offered, chosen 80 percent more often than the next-most popular choice of Venmo. Interestingly, runner-up payment app Venmo is actually owned by PayPal.

Venmo is a relatively new player in the game, having launched in 2012 ― PayPal purchased it in 2013 -- but it has grown quickly and gained a loyal fan base, according to CNN. Google Wallet and Square Cash are lagging in popularity among the survey respondents.

READ MORE: Google Wallet Could Be Your New FDIC-Insured Checking Account

Fee-Free Payments

P2P payment apps are a popular option as a fast, easy way to send payments that is also usually free. But some millennials might avoid the products if they perceive they will incur a fee.

"I think many users may not know that they can use these apps for free," Weliver said. "There may be a perception in the marketplace that it still costs 2 to 3 percent anytime you transfer money."

All four apps included in this survey offer a free way to pay, and paying through these apps usually only incurs a fee if the user pays by credit card. For instance, paying through either PayPal or Venmo from a linked bank account is free, but paying from a linked debit or credit card will incur a processing fee of around 3 percent, reported tech news site Re/code.

More Convenient Access to Money

In addition to being free, these apps offer convenience. If a person owes money to a friend, he doesn't have to remember to get a certain cash denomination back at the grocery store checkout or make a special trip to the ATM.

"In the past, you'd either have to meet face to face to exchange cash or ask your friend to mail a check," Weliver said. Instead, now a person can simply open a payment app, type in an amount, enter the recipient's information and press send.

READ MORE: How Venmo's Security Holes Put Your Money at Risk

A 2015 Gallup report found that 73 percent of people ages 18 to 29 check their phones every few minutes or at least a few times every hour. So for millennials who are constantly on their smartphones, having the ability to pay from the device always at their fingertips is a highly convenient option.

Easily Prompt Friends for Repayment

P2P payment apps also offer additional benefits beyond facilitating easy money transfers, such as features that allow someone to prompt another person to make a payment. "The biggest benefit to payment apps is you can email or text a link and all the other person has to do is click it to pay," Weliver said.

This feature makes it simple and even less awkward to ask to be paid back, which is especially helpful for millennials because they are more likely to be lending and borrowing money than other age groups. Having a low-pressure way to keep track of and communicate about money owed can help alleviate social awkwardness.

Moreover, these reminders can increase the likelihood that millennials will get reimbursed. "When trying to collect money, the squeaky wheel will get paid first," Weliver said. "I think it's OK, and a good idea, to send a request 1) right after you loan the money, 2) a couple days later and 3) every week thereafter."

Weliver suggested that whenever lending money to family or friends, people should view it as a gift ― one they can afford not to have paid back. "At some point it will come down to getting paid back or keeping your friend," Weliver said. "If you're hounding your friend for money every week for six months, it's going to be hard to stay friendly."

PayPal Is No. 1 P2P Payment App for Millennials

PayPal is by far the most popular P2P payment method. The 18-year-old payment service is the most established of the four included in this survey and has more than 179 million active user accounts worldwide.

Many millennials likely already have PayPal accounts, trust the service and have used it to make payments to retailers or vendors. PayPal has greater recognition and familiarity for millennials, so they're more likely to adopt its P2P payment service, PayPal.me.

With a wider user base, PayPal users avoid one of the biggest issues of P2P payment systems: "In order for these apps to work, both people have to be using the same app," Weliver said.

With PayPal, it's more likely that the payer and payee will both have accounts, especially among millennials, making money transfers as simple as exchanging email addresses. Weliver said that the longer it takes for a digital payment service to activate an account, or the more complicated it is, the more those requirements can deter potential users from signing up.

READ MORE: 5 Reasons Why No One Goes to the Bank Anymore

Exchanging funds with PayPal does have some drawbacks. "A big one is the time it takes for the transferred money to actually hit your bank account: a few business days," Weliver said.

"While you can use a PayPal account to make purchases [right away] ― and that's what PayPal would like you to do ― most users will want to transfer the funds back to their checking account so the money can be used for the bills and other expenses that are paid from that account," he said.

Bank Transfers and Checks Equally Unpopular Among Millennials

The least-popular payment options for millennials when paying or getting paid by others are checks and electronic bank transfers, accounting for 8 percent of responses each. In fact, as the most popular P2P payment app, PayPal was preferred as a way to pay over checks and bank transfers. Compared with cash and payments apps, checks and bank transfers are viewed as less convenient and potentially riskier because they might involve sharing more sensitive personal and financial information than other payment methods.

Electronic bank transfers are payments a payer makes directly through his bank's account management interface, either online or via a mobile app. While this payment method is shown to be less favored by millennials in this survey, several big banks are in talks to partner with Apple Pay to allow easy P2P payments from their accounts, reported The Wall Street Journal.

READ MORE: How Your Bank Is Rapidly Adapting to Millennial Banking Habits

Then there are checks, one of the oldest forms of payment still used by 55 percent of American consumers to pay each other, according to the The Wall Street Journal. But among millennials, checks are an unpopular option to pay back friends or get paid back. The First Data report on millennials found that over one-fifth of this generation has never even written a physical check.

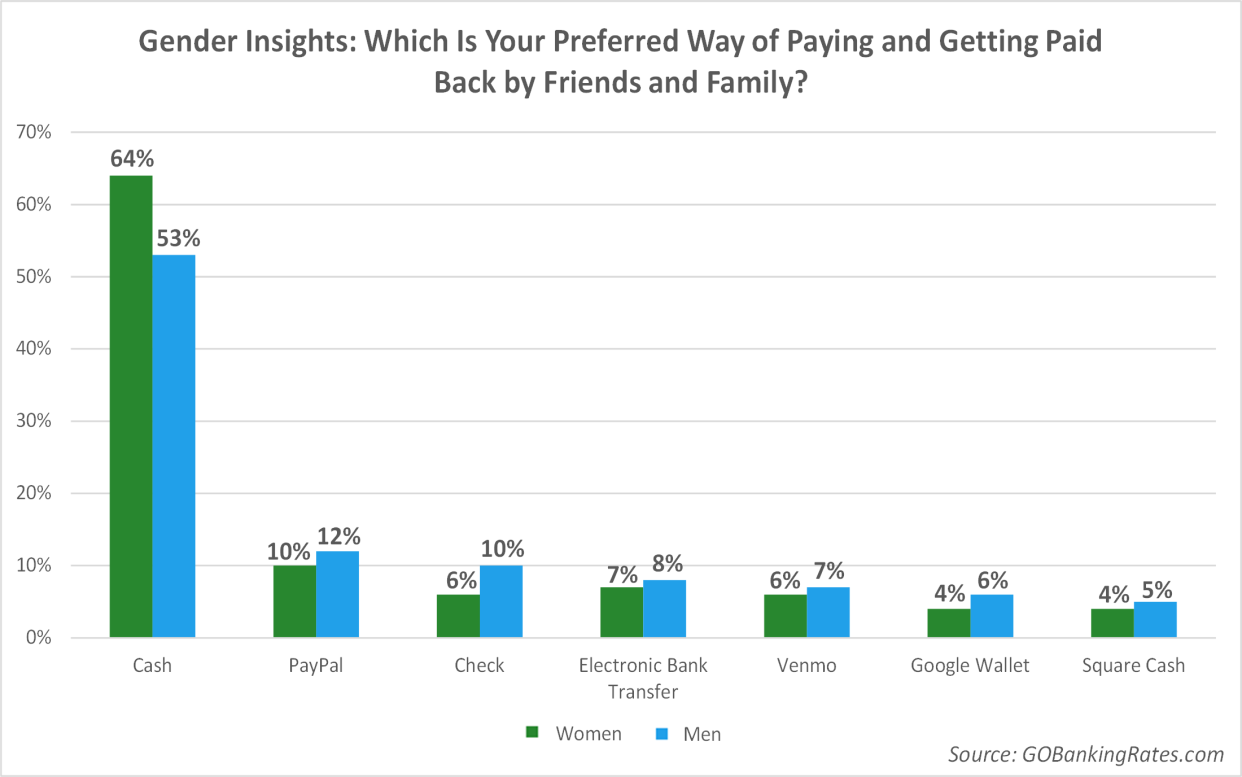

Women Have a Stronger Preference for Cash

Looking at the survey findings by gender reveals some differences between how men and women prefer to pay and get paid by family and friends. Female millennials are significantly more likely to prefer getting paid in cash than male millennials are; women chose cash 21 percent more often than men did in this survey.

Millennial men, however, are more likely than women to prefer nearly all other payment options. The biggest difference is for checks, which 10 percent of men prefer compared with just 6 percent of women. This difference makes millennial men 67 percent more likely to prefer paying and getting paid with a check.

However they prefer to pay, millennials have more choices than any other generation has had before on how and when they interact with their money. They have the freedom to find the payment option that works for them and their wallets — and having a range of choices is important to these young consumers. What is yet to be seen is whether digital money management options will enable millennials to develop smart money habits or whether these options will make it too easy to over-lend and overspend.

Methodology: GOBankingRates conducted a Google Consumer Survey from Jan. 21-23, 2016, that collected 1,000 responses from U.S. internet users ages 18 to 34, the age range of millennials. The survey posed the question, "Of the following, which is your preferred way of paying and getting paid back by friends and family?" and provided seven possible answers, displayed randomly: cash, check, electronic bank transfer, Google Wallet, PayPal, Square Cash and Venmo. Respondents were limited to one answer. The survey answers have a 0.5 percent margin of error. Analysis of answers by gender was limited to responses for which the respondents' relevant demographic data was available.

This article originally appeared on GOBankingRates.com: 58% of Millennials Still Prefer to Get Paid With Cash

More from GOBankingRates:

20 Ways to Pay Less at Costco

9 Excuses You're Making to Avoid Saving for Retirement

40 Mindless Ways You're Burning Through Your Paycheck

RELATED: Millennial salary across the U.S.